While life insurance claimants expect a financial benefit, many are seeking more from the claims process which can be complex and onerous during a stressful time of life.

As part of its ongoing research, the Beddoes Institute has found that education and awareness of what is taking place are key issues for many claimants.

Following on from recent articles in Riskinfo, Beddoes Institute Director, Dr Rebecca Sheils unpacks what is on the mind of claimants and how advisers and insurers can assist them.

In May of this year it was shown that more than half of advisers surveyed believed they had a joint role with insurers to assist their clients when it comes time to claim, however almost a third of advisers felt differently (see: Managing Client Expectations: A Job for Advisers or Insurers?)

At that time, the Beddoes Institute described the relationship between advisers, insurers and claimants as complex and “multi-dimensional”, warning that if the respective roles and responsibilities of advisers and insurers were not more clearly defined then client dissatisfaction and a loss of faith in advice and insurance may ensue.

Following the publication of that article, Riskinfo conducted a poll asking its readers whether the respective roles of advisers and insurers needed to be better defined at claim time and found that 72% of its readers thought they did (see: Claim Time – Advisers Seek Greater Clarity).

Many claimants enter the application process with great uncertainty and worry about whether their claim will be paid based on what they have seen and heard in mainstream media over the last 18 months

In responding, one adviser described their role as a facilitator for their client in order to make the process as efficient and simple as possible and another stated that it was important for advisers to keep their “finger on the pulse” of the claims process as a duty of care to their client.

All those who commented seemed to agree that at a time when their clients were in need and third parties such as legal and consulting firms are stepping into the mix, advisers need to work collaboratively with insurers in actively managing their clients to achieve the best outcome possible.

In our latest research, the Beddoes Institute can reveal what claimants are expecting and what insurers and advisers can jointly deliver at time of claim. (These findings are from the Beddoes’ Policyholder Perceptions Study and the Claimant Journey Study – part of the rolling Life Insurance Industry Performance Barometer and the foundation for the joint AFA and Beddoes Institute Consumer Choice Awards. [http://www.consumerschoice.org.au].)

A Shared Philosophy

When a client initiates a claim, they have had a major health event that has turned their life upside down. Their focus has to be on their health and a cumbersome and onerous application process can detract from this.

Many claimants enter the application process with great uncertainty and worry about whether their claim will be paid based on what they have seen and heard in mainstream media over the last 18 months. This imposes additional anxiety and added financial stress during an already difficult time.

Claimants need ongoing proactive communication while their claim is being assessed and they need the decision to be made quickly so they are not left wondering and assuming the worst. They need to have their mind put at ease so they can focus on what is most important – their health. This is what insurance is all about.

This requires the adoption of a client-centred approach where the claimant is put at the heart of everything that is done.

The New Claims Process and the Role of Technology

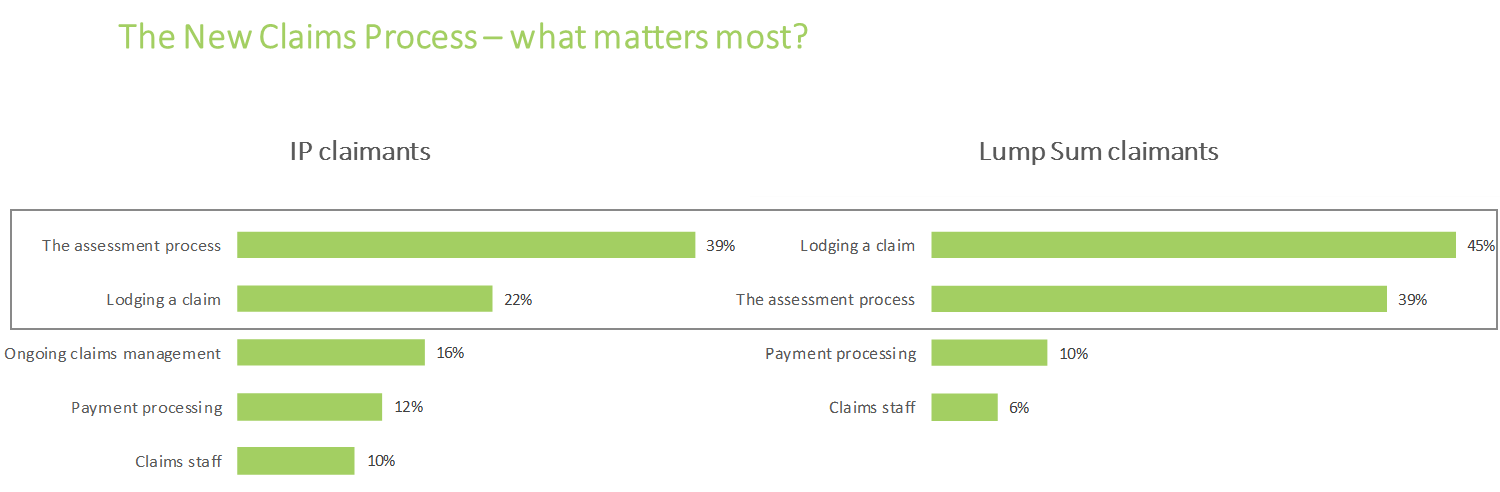

For both Income Protection and Lump Sum claimants (trauma and TPD claimants), analysis of claimant feedback showed that the most important stages of the claimant’s journey were lodging the claim and the assessment process. These stages were much more important than all other stages in the claimant’s journey.

Specifically, claimants need to have an easy application process during lodgement (appropriate information requirements, easy lodgement process etc.), staff who understand the needs and circumstances of each individual and are able to tailor their services and approach accordingly, and assistance available to claimants for the completion of the application forms if needed. The latter is particularly important as many claimants are not capable of doing this on their own, especially in the case of mental health claims.

The specific needs of claimants during the assessment phase are principally associated with speed and efficiency, having suitably qualified assessors available who follow a transparent, diligent and fair process to determine claim eligibility, and finally a process that proactively keeps the claimant informed with progress updates.

The Role of Health Support in life insurance

Many customers – both policyholders and claimants – do not understand the role that an insurance company can play in facilitating their return to health and wellness nor do they understand the benefit of receiving holistic biopsychosocial (BPS) health support from their insurer during a claim.

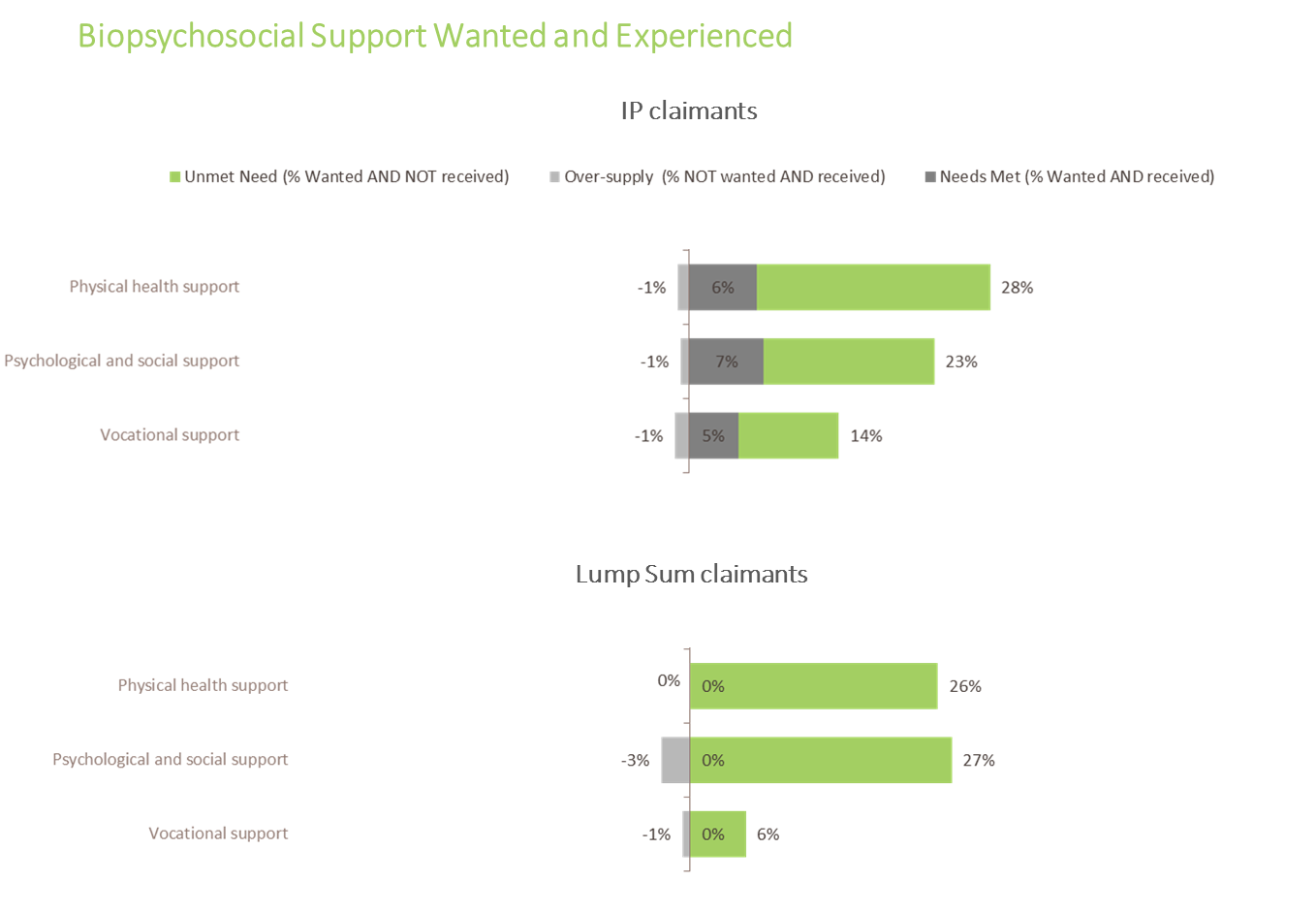

Surprisingly, 28% of claimants thought they would benefit from physical health support, 23% from psychological and emotional support and 14% from vocational support. This is surprising given that two thirds of these claimants had a moderate to severe condition with a medium to long term duration.

Despite the apparent low level of “need”, only 5%-7% of IP claimants and no lump sum claimants are currently receiving these supports at an industry level.

Claimants often enter their claims journey not understanding their policy, level of cover, the claims process or the role that insurers and advisers can play to help facilitate their return to health and wellness

Education of Claimants

We believe that with education, more claimants would understand the benefit of receiving holistic BPS support and demand for this would be greater. This in turn would lead to a faster recovery and earlier return to health and wellness.

Customers need to be educated at the start of their customer journey with their insurer and this education needs to continue at the time of claim. This means educating policyholders when they first take out their policy that their life insurer is able to assist beyond providing a financial payment.

Claimants often enter their claims journey not understanding their policy, level of cover, the claims process or the role that insurers and advisers can play to help facilitate their return to health and wellness.

Therefore, education is of paramount importance during the early stage of a claim, keeping in mind that the claimable event may well have impacted their cognitive functioning, especially for claimants with mental health conditions. As such, any information and education needs to be delivered multiple times across multiple channels and will often need to involve a broader support or carer network. Keeping the customer informed of where things are at during the assessment process is critical.

Again, taking a claimant-centred approach, the fundamentals of good customer service, including proactive communication, are even more important to claimants as a customer group given the significant health issues they are facing and the associated stress. This is a role for both the insurer and the adviser.

Leading Practices for Insurers

Based on many interviews with claimants and the findings of the Life Insurance Industry Performance Barometer Claimant Journey Study, leading practice guidelines for managing the claimants’ journey would include insurers doing the following:

- Undertaking a detailed risk assessment when claim is first received to evaluate whether BPS health support is needed (after educating the claimant about the health support available).

- Recruiting claims staff that are appropriately skilled to complete risk assessments.

- Incorporate suicide risk assessment and reporting in ongoing claims staff education, especially for mental health claims.

- During first contact, ask the claimant about their communication preferences during the claim and ask which other family members or friends should be included in the communication, obtaining permissions if communication is to go through a support person.

- Develop a tailored, multi-disciplinary care plan tailored to the specific needs of each individual claimant.

- Establish early intervention service and support protocols that involve a multidisciplinary team using a BPS health and wellness framework.

- Create multidisciplinary health service teams comprising psychologists, OTs, physiotherapists, social workers etc. to undertake weekly case conference reviews of all claimants and provide supervision to all allied health workers.

- Train claims assessors about the support services available in the community, through private health insurance and other health and carer services.

- Develop systems and processes that allow for communication to be tailored to each individual and that includes regular and proactive contact (i.e. at least weekly) using each individual’s preferred channel/s of communication.

- Establish the broader, holistic needs of lump sum claimants using a BPS framework of health and wellness to identify needs

- Consider provisional acceptance of straight-forward claims to allow for early intervention wherever possible

- Establish an ongoing claims management plan that is underpinned by a BPS model of health and wellness and that is outcome focused with clear goals agreed with the rehab team and claimant, along with accountabilities and timelines.

- Develop mechanisms and metrics for tracking outcomes for each individual claimant.

Advisers should participate in the claims process as much as is practical, facilitating the lodgement of the claim and being available to assist during the assessment process. They should be familiar and educate the claimant about the services available from the insurer and they should be available to advise their client when the outcome of the claim is known, including providing quality financial advice service to lump sum claimants.

About the Research

The Life Insurance Industry Performance Barometer delivers insights into the needs and expectations that advisers and customers (policyholders and claimants) want from life insurance companies and maps how companies perform in terms of meeting these needs.

The Life Insurance Performance Barometer Claimant Journey Study was designed collaboratively with industry, advisers and consumers using a customer journey framework. The specific dimensions measured within each stage were constructed from in-depth interviews with a large number of claimants in order to understand their needs and expectations during a claim.

Dr Rebecca Sheils is Director and co-founder of the Beddoes Institute, which specialises in delivering research and consulting services to the financial services sector.