Recent research has found many advisers have yet to prepare for the LIF changes set to begin in less than two months.

While it may seem a little late to start the process, Sue Viskovic from Elixir Consulting believes preparation is still essential to guarantee the continuity of advice in the future.

Sue shares some last minute tips you can use to ensure your business is ready for the LIF, even if you are one of those advisers who has yet to start the process.

With the countdown on to the commencement of the LIF, we’ve been having many conversations with licensees and insurers who are concerned about helping advisers to prepare their businesses. They’re concerned because they see an alarming number of advisers who are still writing risk on upfront commissions and are not feeling ready for the new regime.

When you take a look at the recent research released by Zurich, you begin to get a sense of why they are concerned. Of 200 risk advisers surveyed, 60% are “still yet to measure the impact the new regulations will have on their business cashflow”. We see this as a critical first step to prepare for the changes ahead. It is only when an adviser measures the impact these changes will have directly to their business (not just as a general comparison of what has been in place vs what is coming), that they get any sense of urgency.

the fact remains that you deliver an incredibly valuable service to our community

We see advisers at various points on the spectrum. From those who think this is just a natural evolution of business and no big deal, to those at the other end who are still feeling they are the victim of a conspiracy. Regardless of where you’re sitting on this spectrum, the fact remains that you deliver an incredibly valuable service to our community, and it is in your clients’ best interests – those you currently serve AND those still needing your help – that you are a successful business owner in years to come.

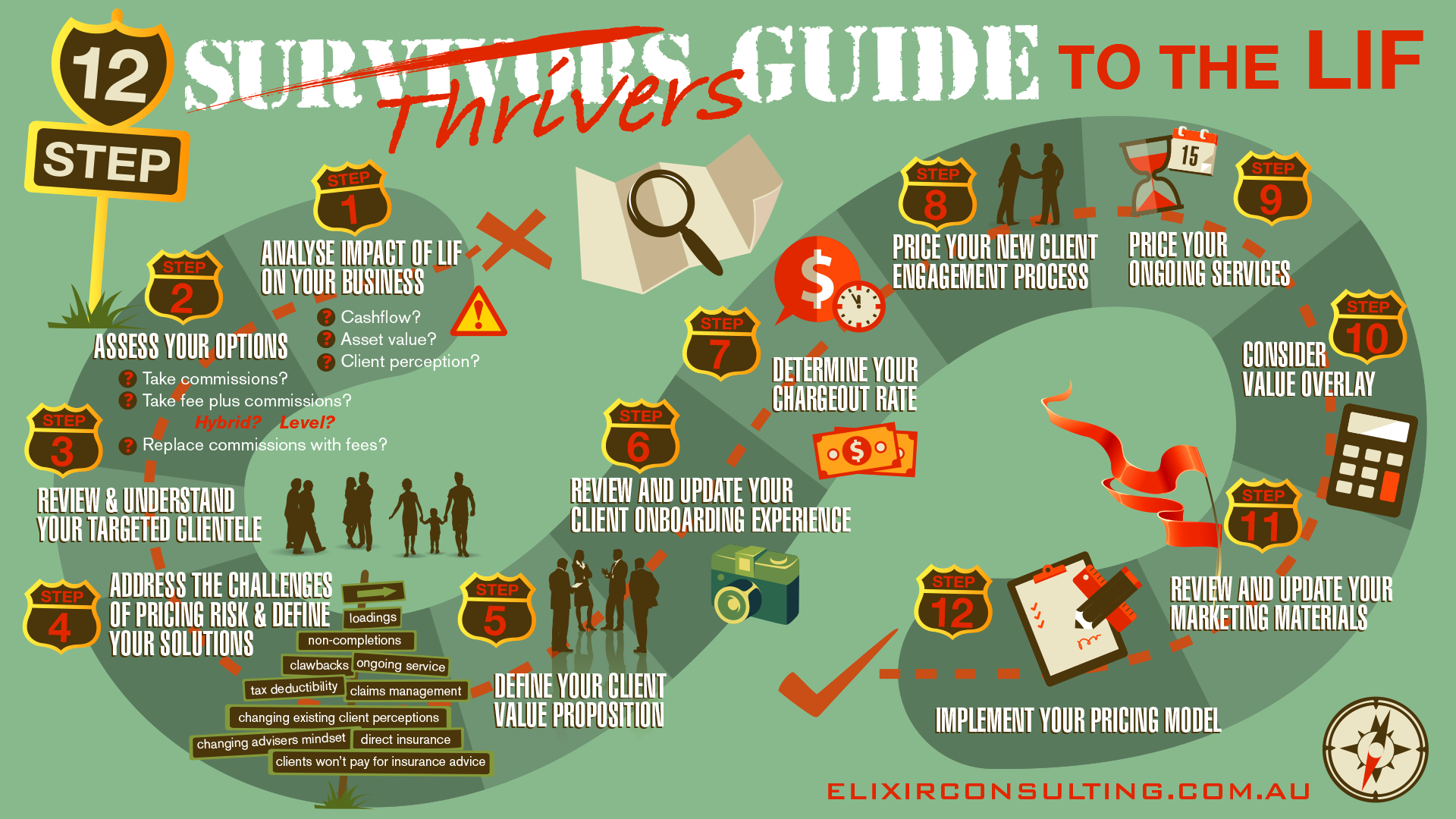

Having written a book on how to evolve your risk advice proposition (‘Worth Paying For’), I’ll share here, some of my last-minute tips for things you can do to help get ready for the changes ahead. The image below – the ‘Thrivers Guide to the LIF’ outlines the steps you can follow to prepare.

A few key elements to consider along the way are as follows.

- Don’t underestimate the power of that first step. If you haven’t yet done so, I implore you to utilise the tools that are being provided by a number of insurers, and start out by crunching your own numbers… adjusting the assumptions to suit the reality of your own business. Once you get a handle on the impact to your business, you can decide just how urgent this is for you, and then plan out your own timeline for making adjustments to your business model. There is a fair amount of thought required and it’s likely to take time to prepare, so don’t leave yourself too exposed and expect that you can get this sorted in the Christmas break!

- If the numbers you crunch send you into a panic, don’t mislead yourself into thinking that you have to simply batten down the hatches, lay off staff and spend the next four years working extra hours to make up the shortfall. As shown at Step Two of the chart above – you do, in fact have some options for how you’ll evolve your business model. If you’re still of the mistaken belief that ‘clients won’t pay for risk advice’, or that you have no options, open yourself up to other versions of reality. There are plenty of articles to read, videos to watch, conference sessions and webinars to attend – even podcasts to listen to, where you can hear about alternative options. Learn more about the options so that you can choose one that feels like the best fit for you and your clients.

- Steps 3 through 6 are important elements that will help you hone your ability to find the best clients for your model and place yourself in the best position to truly articulate the value of what you do for your clients. You might find that you can improve your efficiencies as well as your level of engagement with your clients, and a common by-product of this process is quite often deeper relationships, lower lapse rates, and higher referral rates. Not bad side effects at all!

- Steps 7 through 10 are necessary to arrive at your ‘Minimum Recoverable Amount’. This amount will vary from one business to the next so don’t shortcut this by simply taking numbers you’ve heard as estimations. Once you know how much you need to generate from clients in order to deliver your services profitably, you can make better decisions about how you will receive that income. Commissions may still suffice – or you may require an alternative option.

There are many elements to consider, and the fact remains that it’s well worth the effort. For those who don’t have a copy of my book, you can access a detailed checklist of things to prepare here. I wish you the very best, and look forward to seeing the outcomes of your work in the claims stats and hopefully, an increase in protection levels across Australia.

In Practice Management, Elixir Consulting shares strategies for building better advice businesses.

Sue Viskovic is the founder of national consulting business Elixir Consulting; a popular speaker; a business coach; and author of a number of books and programs designed for advisers.

An award-winning advocate for financial and risk advice and small business, Sue’s most recent achievements include her latest book Worth Paying For, which has become a lifeline for many advisers impacted by the LIF, and the fourth edition of the Adviser Pricing Models Research Report

Contact or follow the author: Website | Email | Twitter | Facebook | YouTube