The Beddoes Institute Director, Dr Rebecca Sheils, shares insights on what is most important to advisers in relation to underwriting based on feedback in Beddoes Institute’s Adviser Experience Benchmarking Study, one of three customer experience benchmarking studies that make up the Life Insurance Industry Performance Barometer. The goal of the Barometer is to assist life companies deliver an improved customer experience that will result in stronger advocacy, more new business, better customer retention and more profitable and sustainable businesses.

With around 75% of life insurance policyholders satisfied with their adviser and their life insurer, how do advisers rate insurers?1

The Adviser Experience Benchmarking Study

This study evaluates life insurers’ performance across key operational areas including product, underwriting, claims management, business support and the BDM team as judged by advisers.

Advisers are asked to rate their level of satisfaction with insurers performance in each of these areas and then asked to explain the reason for their rating which resulted in 4,800 comments from advisers.

With the 2018 Adviser Experience Study launching this month, we reflect on the themes that emerged in relation to the operational area of underwriting from adviser comments in the 2017 study.

We reviewed the comments given by advisers who rated their insurer 9 or 10 out of 10 and then analysed these thematically. The objective of the analysis was to identify the specific service areas that drive high satisfaction among advisers i.e. performance characteristics that advisers wanted in 2017. These are communicated to insurers to enable them to focus their efforts on what is most important to advisers and their clients.

Underwriting

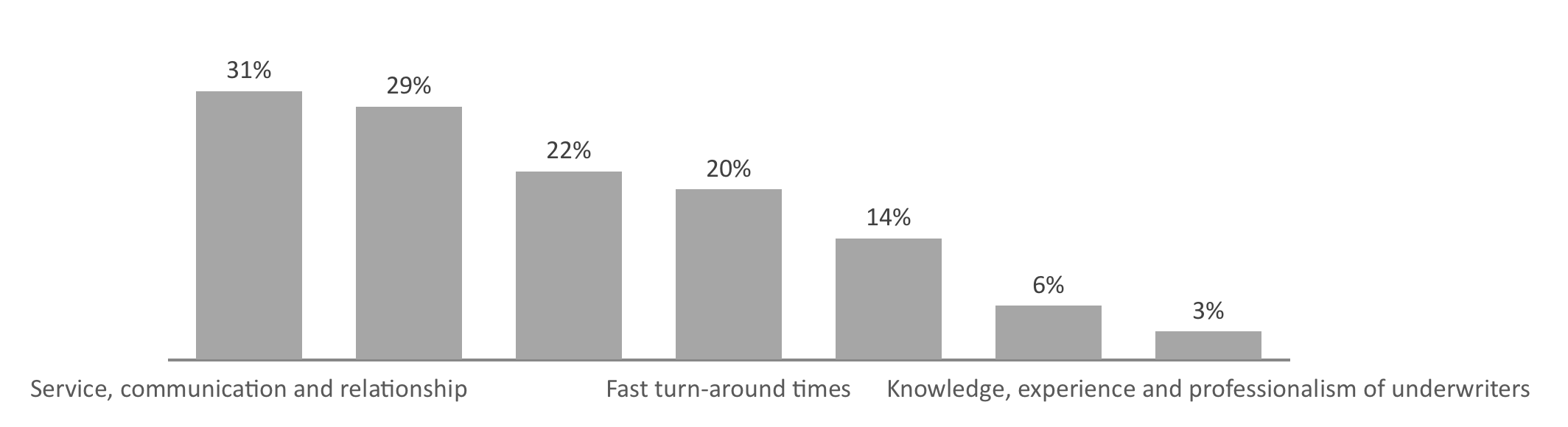

So what mattered most to advisers in relation to underwriting in 2017?

The following chart shows the key underwriting themes that emerged and the percentage of advisers that mentioned each as the key reason for high satisfaction with their insurer.

The analysis revealed that in 2017, advisers expected underwriting teams to deliver high levels of service, excel at communication and interpersonal skills and offer easy access to underwriters to discuss cases and decisions. These, in addition to having an easy application process and fast turn-around times, were the most sought after characteristics of the best underwriting teams.

Each of these themes is described in more detail below along with a selection of comments from advisers to illustrate their meaning.

Service, communication and relationship (31% mentions)

Advisers valued proactive communication and contact about progress and underwriting decisions, being responsive to enquires and returning phone calls or emails quickly, proactive follow-up, helpfulness, anticipating issues and going out of their way to address these and forging strong relationships with advisers. This is captured in the following comments from advisers:

- Communication has always been easy and very, very quick with underwriters and case managers.

- The underwriter is exceptional thorough and always gives her true opinion.

- They are very good at underwriting. The underwriter kept me informed during the whole process.

- Always proactive in their approach to ensure business is completed.

- They always contact us about the final out comes.

Access to underwriters to discuss cases and decisions (29% mentions)

Advisers valued being able to contact underwriters easily to discuss cases, loadings and exclusions, willingness to provide guidance before lodging an application and having a dedicated underwriter as illustrated by the following comments from advisers.

- The main things we look at is the ability to have discussion with underwriter, ease of administration and ease of contacting the underwriter for commercial decision.

- Underwriting is fast and candid – if they cannot do it they explain why.

- Underwriters will ring you directly and explain any issues which also allows you to put forward your point of view if you don’t agree with their position.

- We can approach to underwriters and we can explain the situation.

- Underwriter calls and explains every decision, works with me to find the best solution to suit my clients. Contactable directly and calls back promptly when left a message to do so. Has taken the time to know me and my business.

- Because I get my own designated underwriter and I get things through quickly.

- We have a direct line to the underwriters so they have been good.

Easy and efficient application processes (22% mentions)

Having easy processes that are simple and easy to follow and that are supported by a good technology platform enabling documents and comments to be uploaded were key drivers of adviser satisfaction with underwriting teams. They also valued online tracking, offering tele underwriting, asking the right questions during the underwriting process.

- Good structure and the quoting summary is straightforward and easy to understand.

- Quick pre-assessment (and good outcome) and quick and simple underwriting.

- Simple application and quoting software.

- I particularly like how easy it is to track where a case is up to online and the ability to upload docs and comments to this system.

Fast turn-around times (20% mentions)

Advisers value speedy assessments and decisions. They believe that this reduces the risk of losing clients and creates much needed business efficiencies for their practices.

- The applications is good with immediate result on lodging.

- Very efficient and timely process. Online update and notes very accurate.

- Really quick, fast and easy to deal with.

Flexible, fair and commercial decisions (14% mentions)

This is about fair and transparent processes and decisions and taking a flexible approach to each case and make good decisions that are in the best interests of the client.

- Fair they do required medical investigations quick turnaround.

- Have always found underwriting to be fair and transparent.

- The underwriters have been able to remove exclusions that were attached to pre-existing policies, they are not as restrictive as other insurers.

- In the past some legal conditions were knocked back but now they have better understanding of the conditions and will accept more clients for underwriting.

Quality of new business administration (6% mentions)

Advisers value smooth, seamless and error-free new business administration.

- Great underwriting support. Great back office support for new business.

- Underwriting & new business processing – excellent and timely

- Their admin team are really fast and really thorough and never have any problems pop up but if we do they are always handled quick and efficiently and always willing to help.

Knowledge, experience and professionalism of underwriters (3% mentions)

Advisers value highly competent, knowledgeable, experienced and professional underwriters as evidenced by the following comments.

- Has taken the time to know me and my business. Highly educated and respected in his line of work.

- Have excellent underwriters who are up to date with the latest medical issues.

- Brilliant relationship with a terrific underwriter, who will work with us for the best client outcome and show empathy and commercial acumen. New biz gets the job done and is responsive.

Products

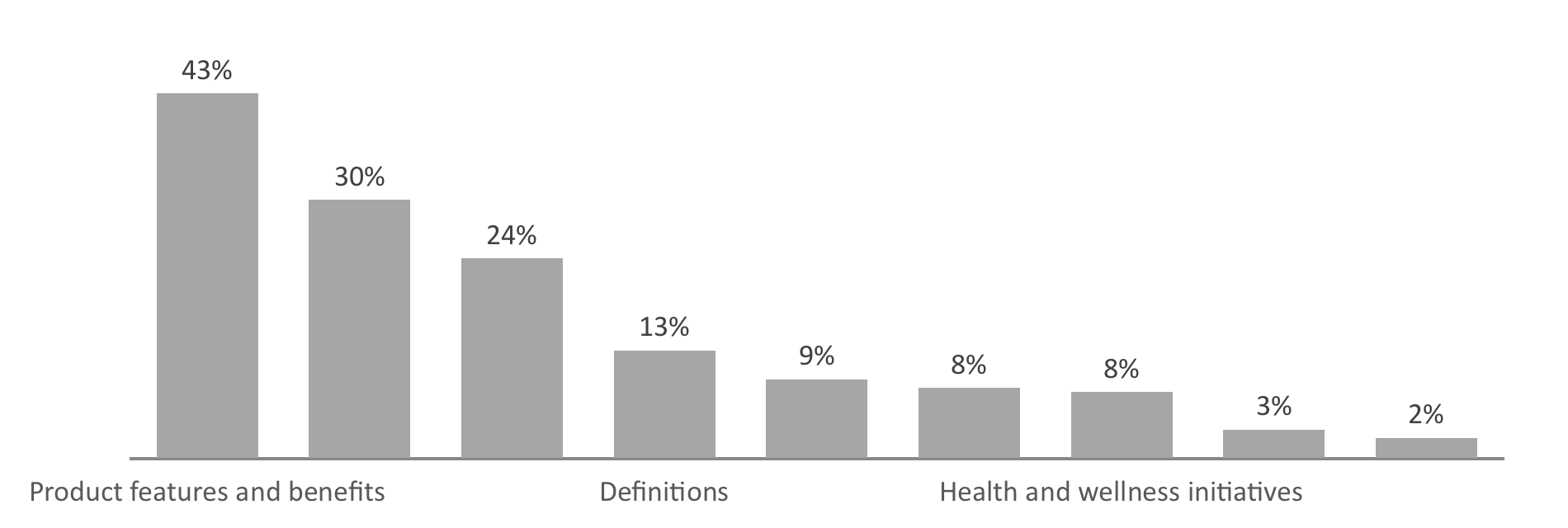

So what mattered most to advisers in relation to products in 2017?

The following chart shows the key products themes that emerged and the percentage of advisers that mentioned each as the key reason for high satisfaction with their insurer’s products.

The analysis revealed that in 2017, Product features and benefits and overall suitability to the end-client were the main driver of product satisfaction for most advisers. This is closely linked to having solid and up-to-date definitions as this provides certainty should a claim be needed. They also value flexibility in products that enables them to offer different features and tailor the policy to the specific needs of the client as well as having the flexibility to choose the revenue structure. Unsurprisingly, cost of the premium and value for money also feature strongly.

Each of these themes is described in more detail below along with a selection of comments from advisers to illustrate their meaning.

Product features and benefits (43% mentions)

Product features and benefits and overall suitability to the end-client were the main driver of product satisfaction for most advisers. Advisers actively evaluated products and their overall suitability to clients in terms of the level of cover, waiting and benefit periods, exclusions and occupations covered, including niche occupations. Research house ratings also played a role in some advisers’ view of product features and benefits. This is captured in the following comments from advisers:

- The product suitable for my client type.

- Competitive in the space of mining and blue collar work. Good policy features and definitions.

- Great definitions and product features. I especially love their true level premiums.

- Quality cover with changing features and benefits relevant to the current insurance needs of clients.

- They have the most comprehensive feature.

- They’ve got more benefits inside the products I think their products are very good and come very good in the rating of the research.

Flexible product structuring (30% mentions)

Advisers highly value flexibility in products. They value being able to offer different features and tailor the policy to specific needs of the client, being able to set up the cover in or out of super, having the option of bundling or stand-alone policies, variable payment frequency options and the flexibility to adjust premiums. They also value having the flexibility to choose revenue structure; to be able to dial commission up/down and cater for fee for service and rebate commissions to clients.

- They offer and number of different options to tailor to different client needs.

- Also provides the ability to split policies across super and non-super for best client outcomes.

- I think just the flexibility that is available with their product i.e. different ways that you can structure the cover i.e. you can have a basic product or a comprehensive one.

- This comes down to the flexibility of adjusting commissions for each policy.

- Commission structures are flexible enough/different methods setting commission to suit adviser and customer.

- For the flexibility to choose either commission or fee for service where we can rebate the fee back to the client.

Competitive pricing and value (24% mentions)

Unsurprisingly, competitive pricing and value and also key drivers of product satisfaction for advisers. This aligns with findings from Beddoes’ Policyholder Perceptions Study which has shown that policyholders are sensitive to the rising cost of premiums.

- Competitive premiums for life and IP for some general occupations.

- Top 25% of benefit design and premium costing.

- Value for money and surety of claims.

Definitions (13% mentions)

Advisers value products with comprehensive definitions that are innovative, up-to-date and suited to clients’ needs as this provides certainty for advisers and their clients if a claim is required.

- They are innovative and market leaders on definitions.

- Good products i.e. the policy definitions suit the customer needs.

- Provide what is important to our clients from definition point of view so certainty is there if a claim is required.

- The products are of a high standard and have a good definition of terms. They have fewer exclusions.

Product innovation (9% mentions)

While many advisers believe that there is little product differentiation across insurers, some cite innovation and having market leading products, a focus on continuous product improvements and being responsive to consumer lifestyle changes as the key reason for high product satisfaction.

- They offer innovative product.

- They offer products other company’s don’t offer such as accident cover.

- Usually leader’s in innovation of product and software.

Product range (8% mentions)

Having access to a comprehensive range of products that are consistent in terms of their quality and that meet a variety of different client’s needs is also very important to a small number of advisers.

- Good product offering, especially in light of Child Critical Illness cover.

- Good range of products including accident only products.

Health and wellness initiatives (8% mentions)

Although not appealing to everyone, products linked to health and wellness programs appeal to a segment of advisers who leverage these to deepen client engagement with risk insurance and financial advice.

- Wellbeing program fits with our approach to financial services and helps differentiate in the market. It also encourages greater engagement with risk insurance and financial advice in general.

- Great product with great incentives to become healthier with competitive premiums.

- Best Doctors is a great offering.

- They have a health and wellness on track it give clients a discount for remaining healthy.

Product simplicity (3% mentions)

This refers to products that are easy to understand, policy material that is easy to read and explain to the client and was mentioned by a small number of advisers as being key to their satisfaction with products.

- Easy to read and easy to explain to a client.

- Products is more client friendly on some circumstances and easy to understand.

- Terms of policies are understandable. Transparency is good.

Loyalty Initiatives (2% mentions)

Advisers value loyalty offers that help reduce the premiums thereby making products more affordable to clients. The offer that features most highly is the multi-family and multi-policy discounts. Interestingly, policyholder demand was highest for loyalty programs out of 18 different customer engagement initiatives measured in Beddoes’ 2016 Policyholder Perceptions Study which suggests that advisers may not understand the importance of this to the end-client.

- I really like the features they also have discounts for additional family members / the more people you have insured the larger the discount across.

- They provide good discounts for multiple lives and policies.

- The multi-life discount helps and clients like to keep their policies with the one company so this is a good benefit.

BDMs

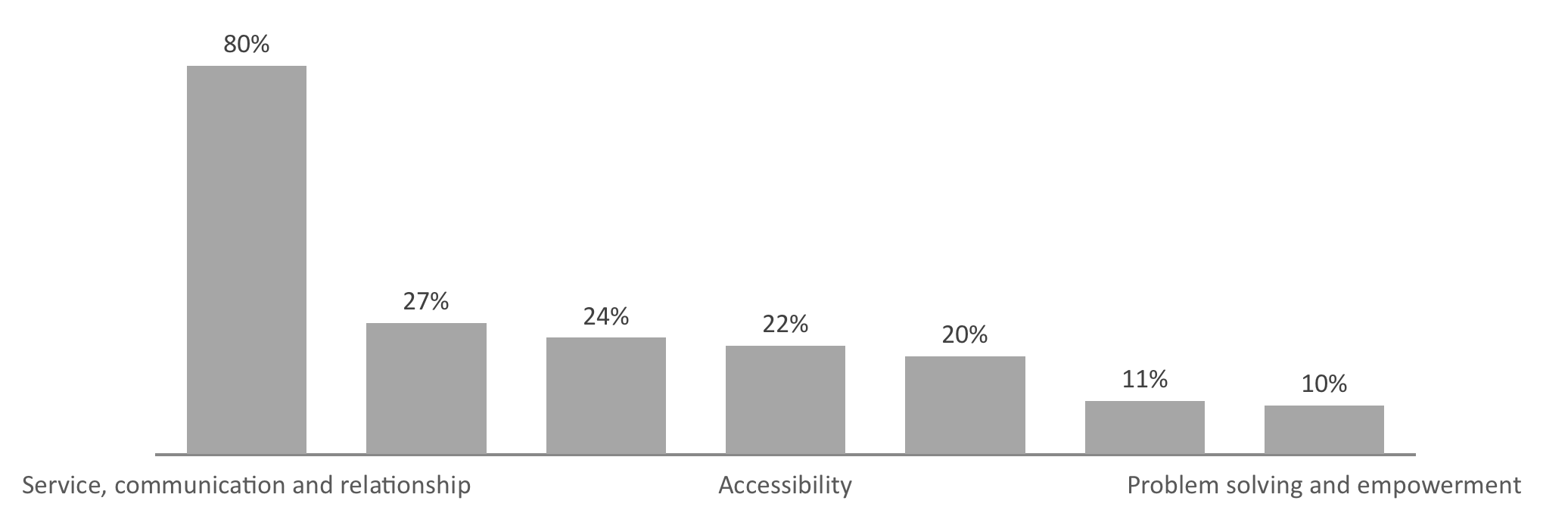

So what mattered most to advisers in relation to BDMs in 2017?

The following chart shows the key products themes that emerged and the percentage of advisers that mentioned each as the key reason for high satisfaction with their BDM.

The analysis revealed that in 2017, interpersonal and relationship skills, communication and a strong focus on service are by far the most important qualities and attributes of a BDM.

Each of these themes is described in more detail below along with a selection of comments from advisers to illustrate their meaning.

Service, communication and relationship (80% mentions)

Interpersonal and relationship skills, communication and a strong focus on service are by far the most important qualities and attributes of a BDM as rated by advisers. Specifically, advisers value helpfulness, delivering on promises, attentiveness, BDMs that go above and beyond, are proactive, reliable and responsive, easy to work with and who have excellent communication skills. This is captured in the following comments from advisers:

- They return my calls quickly and they deal with stuff when I need it done.

- Two years since the relationship began our BDM hasn’t missed a beat. Always reliable.

- BDM understands what we need from our relationship and respects our time.

- A good relationship, knowledgeable, helpful and always responds to calls.

- If I have any queries I just send them out an email and they get back to me promptly and with the information I need.

- Very good at keeping me in the loop, getting back to me in a timely manner.

- Personal involvement and great willingness to help.

Proactive and regular contact (27% mentions)

Advisers value proactive and regular contact from their BDM. Importantly, it appears that telephone contact is acceptable to many advisers as this is an effective means of communication and method of keeping advisers informed about important updates. Proactive contact, irrespective of how much business is being written, is a display of customer focus and support to the adviser.

- BDM makes the time to visit our office or catch-up regularly. He also supported our young adviser when the adviser was first starting out by explaining how the insurance process works etc.

- Continual unprompted contact.

- Regularly comes to the office and updates us on products and updates us of any changes.

- Because the BDMs always check in regardless whether we are writing in or not.

Business understanding and support (24% mentions)

Adviser value BDMs that understand and can add value to their business. This includes truly understanding the business and commercial environment and being able to offer support to help grow the business, offer strategy and product advice, help to improve the insurance processes, help with educating and training junior advisers on risk insurance and genuinely caring about the overall success of the business.

- Every time he visits I learn something new or of value.

- Very helpful for both product, strategy advice and implementation queries.

- They have the best BDM. He was an immense help to me and my business as well as product knowledge.

- BDMs are keen to understand what drives us and our business, and what value they can give. Our BDM has particularly been willing to offer whatever assistance he can, despite not necessarily getting a large amount of business from us.

- Helps me with other things in my business such as referrals. Not just helpful with his own insurance product. Cares about the success of the business as a whole.

- Provides great assistance with tricks and tips on the quoting software and how to maximize benefits and value for client.

- The BDM is engaged frequently throughout the month with development ideas and assistance.

Accessibility (22% mentions)

Always accessible and available when needed, by phone, email or in person, to help assist with getting business through or resolving any issues that may arise.

- They are on the phone at any point in time. They’re able to help you get stuff through quicker if need be. Can find a solution outside the box.

- Always contactable and if unavailable and is left a voicemail, he returns our call that day and will either answer query on the spot or have someone else contact us to assist.

Knowledge, experience & professionalism (20% mentions)

- Experienced and can resolve queries or issues quickly and efficiently, always professional, strong industry and product knowledge

- Excellent BDM, knowledgeable and works extremely hard for us.

- He is always around and very professional.

- Passionate about the industry and future life insurance innovations.

- Quality person with industry knowledge and quick responses.

Product updates, education and training (11% mentions)

Regular product information and updates from the BDM as well as ongoing education and training for advisers and other staff in the business is also a key driver of BDM satisfaction for some advisers. This includes keeping the adviser abreast of industry and product changes, specific and ongoing product and other professional development education and training programs delivered via the BDM.

- Always keep in touch and lets me know of any changes in the industry or with their products. Always available on the phone.

- We have a really good BDM. We see him every three months and he has done training sessions with the para-planners.

- He works through different scenarios with you so that the product is held for a longer period of the client’s life and more importantly, hold the policy at an age where most clients will consider cancelling.

Problem solving and empowerment (10% mentions)

BDMs are often the first ‘port of call’ for advisers when there is an issue that needs to be resolved. Efficient and effective problem solving, especially in relation to helping get new business through, is therefore a very important BDM attribute for many advisers.

- Anytime I make a phone call or email, it doesn’t take too long for her to get back to me with the solution. Also some of the other insurers on my dealer groups APL haven’t even texted me 6 months later.

- Brilliant BDM i.e. good at creating relationships and solves any problems and always in contact.

- Takes ownership of issues and gets things resolved.

References

Dr Rebecca Sheils is Director and co-founder of the Beddoes Institute, which specialises in delivering research and consulting services to the financial services sector.