The revelations stemming from the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services sector means that the industry is presently in genuine crisis mode.

We’re aware of many advisers and advice businesses who’ve been on the front foot with their clients since the Royal Commission revelations and, with their permission, we’ve summarised the thoughts and ideas that some of them have shared with their clients and others – about the impact of the Royal Commission, but also about their commitment to continue to serve their clients’ best interests.

Our final commentary, though, offers a slightly contrarian perspective, provided by Sixpence Media’s Susie Munro, about what she believes advisers need to be saying to their clients at the moment…

Ryan Watson – Tribeca Financial

Watson and his team at Tribeca have characterised the Royal Commission as a step in the right direction, hoping it will bring about what Ryan believes is much-needed change to the industry. In an open letter to his clients, he adds:

When [business partner] Ryan Merrett and I started Tribeca, it was the disdain we had for the industry that made us want to be different. Tribeca was built with the vision of making a positive change in the financial services industry. We have numerous policies, procedures and staff in place to ensure that we remain the ethical and accountable company that we have always been.

…it was the disdain we had for the industry that made us want to be different

Currently, the base level and requirements for becoming an Adviser are much lower than any other industry, with any individual able to complete a quick course and become an Adviser in well under a year. In comparison, all our Advisers are qualified with a university degree and trained extensively before ever handling clients’ finances.

We believe that the most important aspect of financial advice is the relationship between a client and their Adviser. If you’re seeing an Adviser, the only way to ensure that you are getting the advice you desire is to be involved in the entire advice process. This is why we include our clients in all decisions, keeping them informed every step of the way.

From day one, we structured Tribeca to make ourselves accountable for our clients’ quantitative and qualitative goals. This means that rather than basing our advice off a dollar sign, we use emotional intelligence to consider what our clients want from life.

We help clients understand their ‘four L’s’ – Life, Love, Learn and Legacy – so that they can build goals that will leave them truly happy and fulfilled. We assess where our clients want to be in both three and ten years’ time. From here, we’re able to create a financial roadmap that both ourselves – and our clients – are accountable for, allowing them to live their Good Life.

The values our company was built upon – Respect, Innovation, Commitment, Honesty and Empathy – are displayed in every choice we make for our clients.

At Tribeca, we’re our clients’ champions. So, while many in the industry reel from the reforms to come, we will continue to do what we always have – act in our clients’ best interests and help them reach their Good Life.

David Reed – The Retirement Advice Centre

Reed, who was the AFA Adviser of the Year in 2015, has written to his clients in order to express his personal views in light of what he refers to as the unprecedented attention the financial services industry has received…

We are acutely aware of the issues that are occurring within the structural framework of the industry. It is bitterly disappointing the effect that this is currently, and will have, for financial planning in the future.

As a cohort, our industry is at deep risk of losing its social licence to be a trustworthy emerging profession. This is at a time when the demand for quality advice upon retirement savings continues to increase. Yet, with an ever-increasing average age of financial advisers, a serious knock on effect will be where the new graduates for financial planning degrees will come from with an image that is being publicly tarnished.

…our industry is at deep risk of losing its social licence to be a trustworthy emerging profession

I, along with each member of our team in the office have a genuine passion for advice. We do care about public perception and the pride of our profession…

…It is the alignment of the money with your values and understanding of your aspirations that we feel is of immense importance.

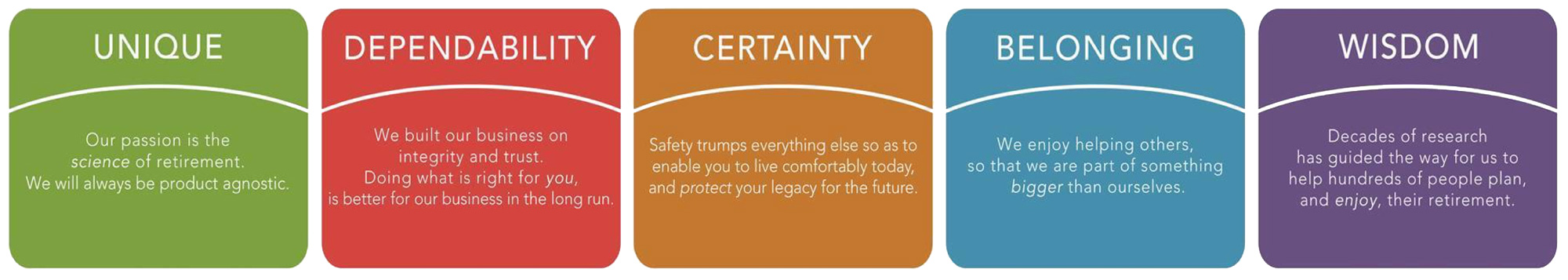

We felt so strongly about the importance of Values, that many years ago our team sat down as a group and created our own for which The Retirement Advice Centre stood for. This was going to be our anchor for which we would make key decisions, such as hiring of new staff and whether their character was in alignment with our culture, direction of where we were building the business for the future as well as benchmarking for every annual salary review with each team member.

I subsequently had a large sign built and erected for our office. It hangs on the right hand side wall as you enter our office. It is likely that you haven’t seen it – it’s not for clients, I purposefully placed it there as a daily reminder for when each of us walks past. The original draft of the sign is shown below:

If we reflect upon what has arisen in the past fortnight with the Royal Commission, it’s apparent that our own values have been breached by members of the financial planning industry.

This is outside of our control, however, I do believe that having these shared values within our office has been a key reason why we continue to enjoy such strong relationships with our clients and team members.

After articulating his vision for advice at The Retirement Advice centre, Reed concluded by looking forward:

It is anticipated that there will be significant structural recommended reforms to the industry. We will await the February 2019 outcomes, however you can rest assured that we will continue to be progressive towards meeting any compliance and regulatory requirements both now and in the future.

It is anticipated that there will be significant structural recommended reforms to the industry…

You can be confident that our culture will always remain steadfast to our values. When it comes to investment advice, we never want to have to say ‘sorry’ to our clients.

We will always appreciate that your money reflects your past hard work, and your future.

We thank you for your trust.

If you have any questions or concerns, please feel welcome to email or call.

Jonathan Hoyle – Stanford Brown

Hoyle stressed the importance of talking to all Stanford Brown’s clients about what they will have been reading in the media about the Royal Commission. He said the revelations had been horrifying and that he and his colleagues at Stanford Brown have experienced a mixture of sadness, anger and bewilderment that such “…appalling business practices” had gone unpunished for so long. He said that for those who love what they do, and who take enormous pride in helping people get their financial lives in order, these have been “…depressing times”:

There is a plaque in our reception which lists our eight core beliefs. The first two say this:

‘The financial well-being of people drives, in large part, the quality of their lives.’

‘Our clients have the right to expect us to put their interests and their future above everything else.’

Financial planning matters. It matters because quality advice has the power to transform lives. It matters because poor, unethical advice has the power to destroy lives.

The Royal Commission has called into question many common practices. First and foremost, is whether the banks and the major financial institutions are fit to run financial planning businesses as well as manufacture financial products. The temptation to cross-sell funds into their own client networks would appear just too high. Second, is whether financial planning can ever fit comfortably as publicly listed businesses, subject to the never-ending quest to drive quarterly earnings-per-share and to maximise shareholder capital. Third, is why has it taken a Royal Commission to expose such rampant corruption. And fourth, the current model of licensing advisers must change, a view we have held for some time.

How we operate at Stanford Brown

Licensing – Stanford Brown is neither licensed, nor owned by any financial product manufacturer. We have our own Australian Financial Services Licence (AFSL) and we are licensed by a company called The Lunar Group – a wholly owned subsidiary of Stanford Brown.

Ownership – Stanford Brown is owned by four staff members (soon to be six), all of whom work in the business today. No one else.

Vertical Integration – There is no Stanford Brown Australian Share Fund or Bond Fund or Property Fund. And nor will there be. This would result in a nasty conflict of interest for us. What if one of these funds started to underperform – would we fire ourselves? That’s not a conflict we wish to entertain. We are free to select the best-of-breed fund managers in each asset class.

What if one of these funds started to underperform – would we fire ourselves?

Education – We believe the current education standards required to be a financial adviser are way too low. It is mandatory for our advisers to be studying for their Certified Financial Planner (CFP), a significantly tougher qualification than is required by law. All our Private Wealth advisers have degrees, mostly in numerate subjects. Thankfully, these minimum standards are in the process of being increased.

Conflicts of Interest – They exist in every business, every walk of life. Rest assured that we are meticulous in disclosing all real and all potential conflicts of interest. We manage any conflicts that do arise with your best interest in mind.

Compliance – We have a full time Chief Compliance Officer and Head of Professional Standards, whose job it is to monitor and train our advisers, and to make sure the advice you are provided with is not only top-notch but also 100% in your best interests. She reports directly to me. Feel free to ask for our Conflicts Register, our Customer Complaints Register, and our Breach Reports. Providing you with compliant advice is something we take extremely seriously.

How will this impact you?

We can expect another tidal wave of regulation to hit our industry and therefore this company. Much of it is clearly needed and long overdue. The Liberal Party, in resisting the need for a Royal Commission for years, has badly miscalculated. They will now be forced to appear tough.

We can expect another tidal wave of regulation to hit our industry

How will we react? Firstly, like we always do, with a relentless focus on our clients, as our primary goal is to provide you with heroic customer service. And second, we will continue to make significant investments in technology to optimise efficiencies and improve the quality of our service offering. This will help absorb some of the additional regulatory costs that will inevitably emerge.

Our vision is a simple one – to build Australia’s benchmark financial services business; the best place to work and the best place to be a client. We hope you agree. It is an honour and a privilege to serve you.

I know this must be an unsettling time for you and I want to reach out to you to contact me with anything that might be on your mind. Please either drop me an email or call me on 02 9904 1555 at any time.

Susie Munro – Sixpence Media

In a different take on how advisers might respond to their clients about the Banking Royal Commission, Sixpence Media’s Susie Munro suggests, in somewhat of an understatement, that the news generated by the Royal Commission is “…not the kind of publicity the financial advice industry wants.”

In an article entitled ‘Please Stop Marketing’, Munro outlines what she believes client communications about the Royal Commission should not be about, and what they should…

…this isn’t about writing to your clients and reinforcing the good work you do.

It’s not about posting to social media about how trustworthy and ethical you are.

It’s not about lobbying the industry associations to do more to promote the positive side of the industry.

And it’s not about pointing fingers or calling for investigations into other sections of the industry.

This is about putting other people first.

It’s about asking what they need to hear right now, feel right now and see right now.

And I’m certain it’s not a whole lot of financial advisers saying how awesome they are.

I understand the instinctive desire to protect your lot, but I think advisers need to think carefully about how that response might be perceived.

Defensive.

You know what I reckon people want to hear? What they need to hear?

Be sorry

An unreserved apology.

Sincere regret and real empathy for victims and their families.

Whether you think you were part of the problem or not.

A sorry to the people who had bad experiences, who were treated poorly, who lost money, lifestyles and trust.

A sorry for the industry’s repeated mistakes, for being slow to react, for not speaking up.

And a sorry without the, “but she had a degree” or “he was fee for service”; without the, “they were never going to retire comfortably anyway”; and without the, “the industry funds got off easy” passing of blame.

Do sorry

I’m a marketer.

The answer to the industry’s problems right now, isn’t marketing.

It’s a different kind of action.

“What if, instead of spending all that time and money on deciding how to tell customers who we are, we spent more time and money on being who they want us to be?”

— Bernadette Jiwa [Marketing: A love story p.17]

Less time promoting what you care about. More time changing behaviour and structures, and meeting the community’s expectations. And that includes considering the perspectives of all those people who need advice but aren’t getting it.

More time being who the people you’re trying to help, want you to be.

It’s not too late to say sorry.

To be sorry.

To do sorry.

What do you think?