In part two of this series looking at the key findings from the Association of Financial Advisers’ ‘Connecting with Clients’ white paper, Beddoes Institute co-founder, Dr Rebecca Sheils, discusses clients’ preferences when it comes to one-to-many communications…

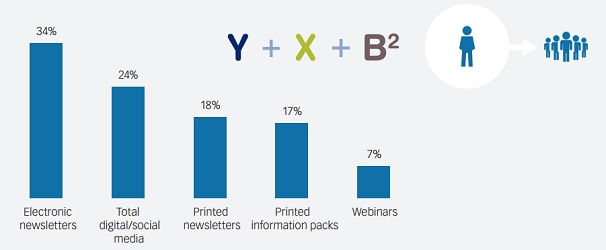

Not surprisingly, face-to-face, email and telephone are the most commonly-used one-to-one or ‘personal’ channels of communication. However one-to-many channels of communication – where an adviser can communicate with many clients simultaneously – are becoming more important and are increasingly used because they have a wide reach and are an efficient means of maintaining contact with clients. The development of the Internet has enhanced this style of communication, especially with the rise of email newsletters, blogs and social media. The graph below presents the results of five one-to-many communication channels most preferred across all generations of clients.

Most preferred one-to-many communication method across all generations

Approximately one in three clients rated electronic newsletters the most preferred form of communication from advisers. Finding that the most popular form of communication is preferred by 34% of clients emphasises the need for advisers to use multiple channels of communication to reach the majority of their clients.

This was followed closely by one in four clients preferring digital/social media. Digital and social media encompasses services such as apps, Facebook, Twitter, LinkedIn, blogs, podcasts and videos (YouTube). Jenny Brown, of JBS Financial Strategists, is a firm believer in utilising social media as an effective means of one-to-many communication, particularly if the communication is properly planned out before it is implemented.

electronic newsletters should now be considered a mainstream means of communication

“The way we looked at the whole engagement piece started with the questions; what do we want to achieve by doing this and how are we going to do it? We found that we needed to bring the whole team on board, get buy in from everybody and explain why we were doing it. We then needed to lay out the plan and describe in detail how it was going to get done,” Brown explained.

Although digital methods of communication were higher on the client’s preference list, the research showed that there is still a place for printed newsletters and information packs. These may be brochures, company profiles, as well as business cards; all of which were considered important branding elements for financial advisory businesses.

Webinars were the least preferred method of communication with only 7% of clients wanting their financial advisers to communicate with them in this way.

These findings have confirmed that electronic newsletters should now be considered a mainstream means of communication for financial advisers wanting to reach their clients in a cost effective manner. If implemented well, they will not only reach more clients than social media channels, but also drive referrals and strengthen the relationships that clients have with their advisers.

FREE Video Service

With thanks to Beddoes Institute, the AFA and white paper sponsor, Zurich Financial Services, a series of brief, value-add videos relating to key points raised in this article are available for all advisers and other riskinfo readers. Click any of the following links that may be of interest to you and/or your advice practice:

Connecting with Clients delivers insights into how consumers interact with advice professionals, and what the best advice practices are doing to set themselves apart. The series is based on the Association of Financial Advisers (AFA) industry white paper research, ‘Connecting with Clients’, conducted by Beddoes Institute and sponsored by Zurich, which measured the most preferred communication channels across more than 500 financial advice clients. To sign-up to receive best practice tips on how to implement each of the communication channels covered in the white paper, visit: connectingwithclients.com.au

Dr Rebecca Sheils is Director and co-founder of the Beddoes Institute, which specialises in delivering research and consulting services to the financial services sector.