Super is a valuable retirement tool, but can also play a key role in widening the provision of life insurance and reducing the impact on disposable income of policy holders. Advisers do not have to grapple with an ‘either/or’ decision as they can access insurance both inside and outside of super, according to the needs of the client. As BT’s Rachel Leong discusses below, there are many advantages to this strategy, but there may also be a few downsides that need to be carefully considered.

Advisers will often be faced with the challenge of providing clients with an appropriate level of cover that is affordable over the term of their foreseeable insurance needs.

Certain measures can be taken upfront, such as selecting level premiums, or ensuring that cover across policies does not overlap. Consideration can also be given to flexible linking and income linking. This describes cover that is linked across the super and non-super environments, which results in a more manageable policy cost over the long-term, as well as a comprehensive level of cover.

Generally, super-owned policies are retained for a longer period of time compared to policies owned outside super. This may be because the effect on cash flow is reduced (sometimes nil) when insurance is held inside super, compared to owning insurance outside super. Therefore, it is a common strategy to own as much cover as possible inside super, while linking to other super or non-super cover to reduce the total cost.

Flexible linking or income linking can be used in a number of ways, such as:

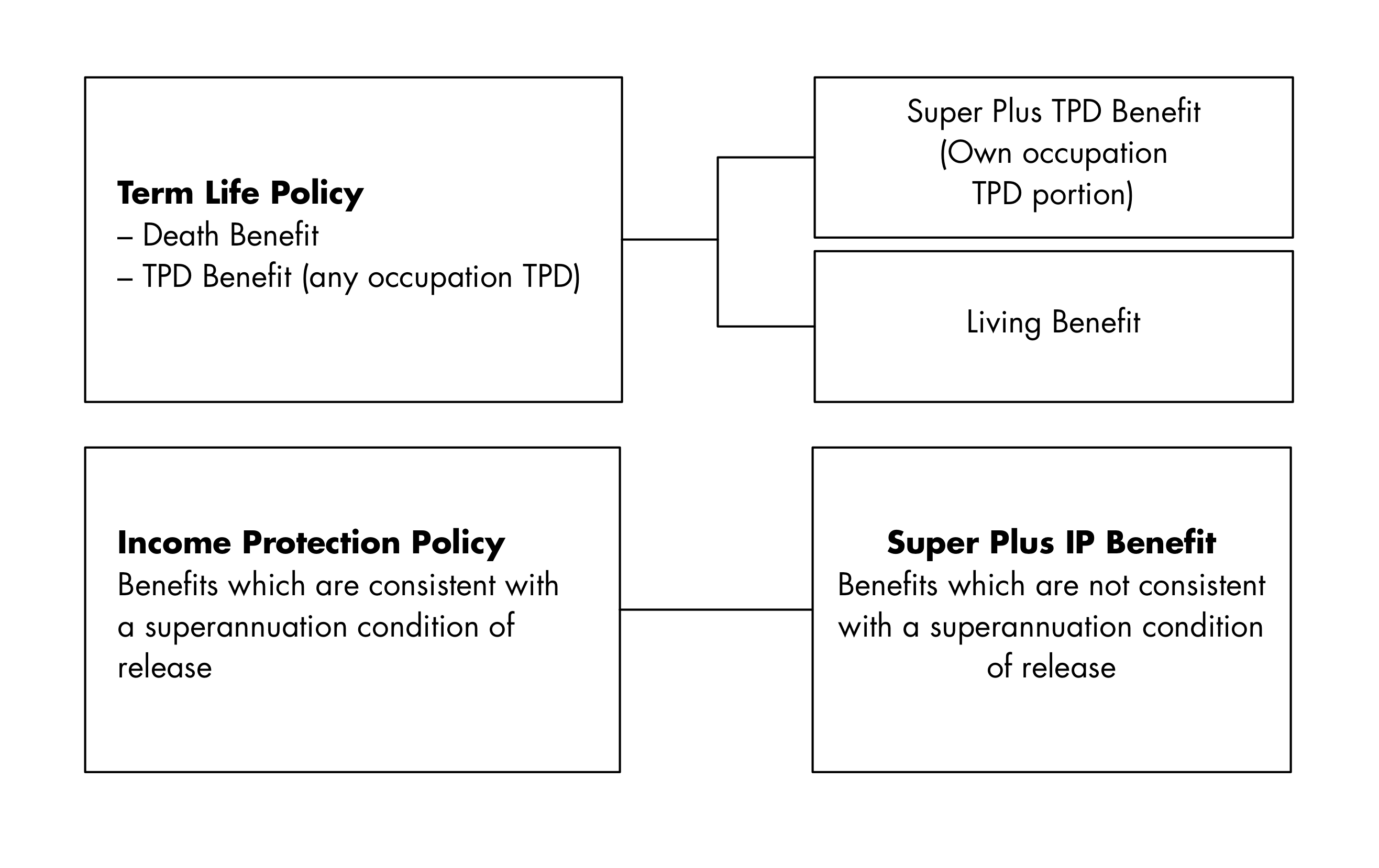

- splitting Total and Permanent Disability (TPD) cover and linking to a Term Life policy inside super

- linking a non-super Trauma (sometimes referred to as Living) policy to a super Term Life policy, and

- splitting Income Protection (IP) cover.

The decision may then turn to what platform to use when housing insurance in the super and non-super environments. Where insurance cover can be held together with an existing investment structure, this can provide simplicity, a ready source of funding, and potentially lower administration fees. The benefits are amplified when a single platform is available for all investments and insurance, whether super or non-super, where consolidated management and reporting functionality is available.

Below we discuss the advantages and disadvantages of flexible linking, and how it can be used with your clients.

Advantages of flexible linking and income linking

Unrestricted cover

Flexible linking means that your client will not be restricted by super law in what type of cover, and the definitions, they can obtain. Any benefits that are not releasable under a super condition of release are held in the non-super portion of cover, thus alleviating any access issues (assuming the definition under the policy has been satisfied). Therefore, clients who need more extensive cover – such as own occupation TPD, ‘plus’ benefits as part of an IP policy, or Trauma cover; can still acquire it through flexible linking.

Paying premiums from super

Flexible linking allows as much of the premium as possible to be funded from super. Premiums may be paid from pre-tax dollars; e.g. salary sacrifice for employed people, or personal deductible contributions. Premiums may also be financed through mandatory super guarantee contributions or deducted from the super balance, however this will ultimately lead to a reduction in retirement savings.

Linked policies

The concept of linked policies is not new, and flexible linking simply extends this idea by allowing linking to occur across the super and non-super environments. This results in a reduced total premium compared to stand alone cover.

Disadvantages of flexible linking and income linking

Paying premiums from disposable income

While the proportion of total premium paid from cash flow is lower than the amount paid from super, this will still affect the client’s cash flow. This should be viewed on balance with the benefits of a non-super portion of cover, which is the ability to have more extensive cover, with any claim proceeds paid directly to them rather than the super fund.

Linked (rider) policies

While linked policies reduce total premium when compared to stand alone cover, the sum insured of all linked policies will reduce after a successful claim is made. This is the same for flexible linked policies. Consideration can be given to buy back benefits that recover Term Life cover, but an assessment should be made on the value of the benefit compared to any additional premium.

Tax

If the client was originally considering owning all cover outside super, flexible linking (which allows a portion of cover to be held inside super) may result in a higher amount of tax payable on any claim proceeds paid. This may be the case where TPD proceeds are paid to someone under age 60, where the insured person is deemed to be so seriously impaired that they would qualify for payment under the any occupation portion of TPD cover.

Example – own occupation TPD

Alana, age 35, suffers from a severe injury while on holiday that results in her being permanently unable to work in any role that would be deemed suitable for her.

If Alana wholly owned her own occupation TPD policy outside super, there would be no tax to pay. However, if Alana used flexible linking (i.e. the any occupation portion of TPD cover is held inside super, and the own occupation portion of TPD cover is held outside super); there would be tax of 22%* of the taxable portion of the super lump sum paid from the fund to her**.

It is important to note that the original purpose of cover was for Alana to insure against her inability to perform her usual role. It is only because her injuries were so severe that she satisfied the any occupation TPD definition, and therefore a payment was made from super, with the applicable amount of tax deducted. Had Alana been unable to perform her own occupation, but could perform other roles, she may have received payment under the own occupation TPD portion of cover, where no tax would apply.

* The rate of tax depends on how old the member is when the lump sum payment is made from super.

** If Alana met the definition for the disability super benefit, a portion of proceeds would become tax-free component, and therefore the taxable portion of the super lump sum would reduce.

Flexible linking in practice

Flexible linking may be appropriate for clients who require:

- comprehensive cover, and/or

- policy definitions that are not aligned with super law but are concerned about how they can fund premiums over the long-term.

Flexible linking may be appropriate for clients who require Trauma cover, and want to reduce the total cost of insurance.

The example below illustrates how flexible linking can work for these types of clients.

Example – flexible linking

Zane’s financial adviser, Amanda, has identified that he requires the following life insurance cover:

- Term Life

- Own occupation TPD

- Trauma (Living), and

- IP Plus.

However, a large proportion of Zane’s disposable income is used to pay for normal living expenses and to contribute to investment property loan repayments. Therefore, Amanda recommends that the policies are set up under a flexible linking arrangement as shown below:

If insurance was wholly owned inside super, Zane would be restricted to the any occupation TPD definition and standard IP cover. He would not be able to purchase trauma insurance at all.

If insurance was wholly owned outside super, he would have access to the same definitions and cover that is achieved through flexible linking, but he would have to fund premiums entirely from cash-flow.

Summary

Advisers who understand the complexities of owning insurance inside super will recognise the opportunities with flexible linking. The structure addresses any concerns associated with accessing proceeds from super, and provides a holistic solution when certain cover may only be available outside super. Given that many clients will want to utilise their super as a funding mechanism, flexible linking provides the ideal answer to what can be an otherwise unmanageable situation.

Rachel Leong is the Product Technical Manager for Life Insurance at BT Financial Group