A new website has been launched that purports to be ‘Australia’s first transparent and independent service to help consumers find, rate and review qualified financial advisers’. There’s already been a plethora of commentary, both positive and negative, about this initiative, however Zurich’s Andy Marshall encourages advisers to take a different perspective…

As Anne Fuchs wrote recently in her communication to AFA members about the ‘Adviser Ratings’, website the initiative has as a strategic objective to give more information to consumers so they can find the right adviser for them. Anne highlighted that technology combined with client psychology delivers an empowered consumer. Surely a good thing?

However, the psychology around online ratings has amounted to social scientists defining the nature of online ratings as the ‘online dis-inhibition effect’: where consumers become increasingly vocal and often with CAPS LOCK ON1. Earlier this year, researchers found that something unusual was occurring with online restaurant ratings; not that they were being hacked, but rather that the weather was influencing the consumers’ reviews. The best reviews were being written on sunny days, highlighting that a person’s mood influences how they feel about an experience.2

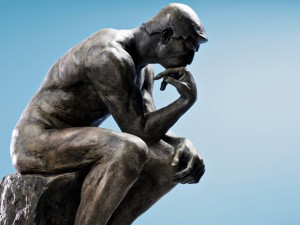

This now has vast and significant impacts on financial advisers because, like a restaurant on Yelp or a hotel on TripAdvisor, advisers just may be rated on the experience delivered. What complicates things for advisers is that the advice experience is not a single hotel stay or one meal; rather, it is a relationship delivered in bite sized chunks over a long period of time, and a relationship in which we as advice professionals are asking the consumer to foresee the future. This unfortunately is where we as humans fall short.

As Derek Thompson remarks, since we humans are terrible at thinking about the future, we make lots of decisions on the basis of how we feel, here and now, rather than how we’re likely to feel in the future. Accordingly, if our advice process does not truly engage a client in respect to their emotional well-being as well as their financial status now and in the future, and we have not truly dealt with the dissonance and fear they face as we deliver a realistic appraisal of their current financial situation, then we may in that moment cause the clouds to pass over the sun and, like those restaurant ratings, be subject to a poor score.

This is problematic and, as Alex Proud points out in his article on review platforms, digital gurus often talk about “the wisdom of crowds” – the idea being that if you get enough people’s input you’re unlikely to be wrong. Alex posits that this works quite well on sites like Wikipedia, but when it comes to book and film reviews, it seems that the wise crowd is more like an “idiot mob”.

The key here then, for financial advisers faced with their performance being rated like a well-cooked or over-done steak, is not the manipulation of the reviews but the manipulation of the mood of the client. This means the ability to positively influence the emotional well-being of the client, and in particular, to identify the process around decreasing the gap or state of dissonance between where a client is now and where they want to be.

There are therefore multiple opportunities for advisers to deliver an experience that so positively impacts a client’s well-being that not only do they rate an adviser well in confidential client surveys, but that the referral likelihood is enhanced. This indeed may transfer to a rating site like Adviser Ratings. We know from studies3 that the financial advice process has a positive correlation with an individual’s satisfaction with life and that occurs irrespective of age, whether you are 25 or 74. For example: thinking through retirement and participating in planning meetings has a positive correlation with retirement satisfaction regardless of an individual’s socioeconomic status.

Making clients happy is key4: happiness makes us want to share and this is within not only our social circle in a physical sense, but now, with a site like Adviser Ratings, in a virtual forum. Happiness is achieved by bonding, and in the financial planner’s office when a client is most likely feeling emotions of fear and anxiety, people look to cope with those emotions by bonding with the adviser and the advice process. As researcher Lea Dunn advises us: “In the absence of friends, consumers will create heightened emotional attachment with a brand that happens to be on hand”. That begs the question: how strong is your financial planning brand, remembering that you and your staff indeed epitomise your brand and it is what clients are looking to bond with?

What is required is a process that embodies your authenticity and, most importantly, has an understanding of the psychology of the client before, during and after the advice process, along with how you can use technology to enhance that engagement. I’m calling this ‘Technoclientology’: the psychology of engaging clients in a modern world, where we combine what we have learnt from neuroscience, modernity and behavioural psychology, in which, when combined with a social world, we can enable clients to make better decisions.

Under the Spotlight provides a life company view of the issues facing the advice industry.

Andy Marshall was appointed to the position of Head of Sales Strategies and Research, Life Risk for Zurich in January 2014.

Contact or follow the author: Twitter

Proud, Alex, 2014, Trip Advisor is Democracy for the Stupid, The Telegraph, UK ↩

Thompson, Derek, 2014, How consumers moods drive decisions, The Atlantic ↩

Kym Irving 2012, The Financial Life Well Lived, Psychological Benefits of Financial Planning, Australasian Accounting Business and Finance Journal ↩

The Science of Emotion in Marketing: How Our Brains Decide What to Share and Whom to Trust : Courtney Seiter ↩