Welcome to the first in a series of articles for riskinfo readers provided by Beddoes Institute co-founder, Dr Rebecca Sheils. In this first article, Rebecca outlines one of the many key findings taken from the most recent Association of Financial Advisers industry white paper research ‘Connecting with Clients’, conducted for the AFA by Beddoes…

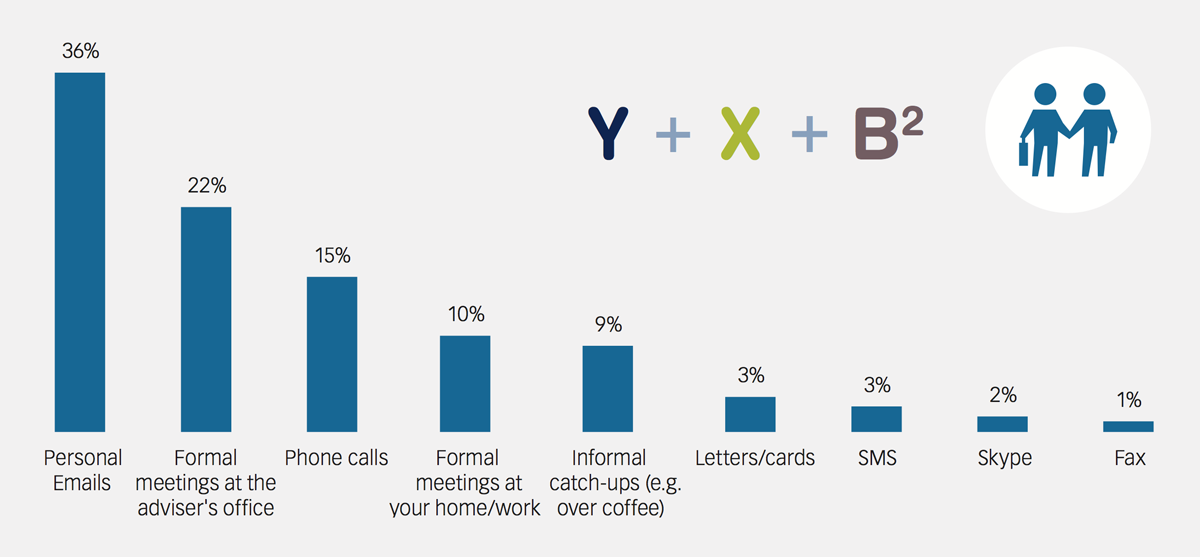

Most preferred one-to-one personal communication method across all generations

This research revealed that personal emails are the most preferred method of personal one-to-one communication. Just over one-third (36%) of all clients surveyed prefer this type of communication above all else, more than double those that preferred phone contact (15%). Formal meetings are the second most preferred personal communication channel for financial advice clients, with 32% of clients surveyed most preferring this type of personal communication – either at the adviser’s office (22%) or at their home/work (10%). While email communication should never be used as a substitute for formal advice meetings, the key message from this research is that advisers need to strike a balance in how they communicate personally with their clients. They need to know when to have a formal meeting and when clear, concise email correspondence and updates are sufficient and preferred, and how to use these to best facilitate the advice process. Furthermore, while many advisers think that a phone call is the most personal way of keeping in touch with a client, the research has shown that emails are in fact more highly desired between the two methods, most probably for reasons of convenience.

the key message from this research is that advisers need to strike a balance in how they communicate personally with their clients

Notably, informal catch-ups, for example over coffee, have surprisingly high appeal, with 9% of clients most preferring this method of personal communication. Other forms of one-to-one communication, such as letters/cards, SMS, Skype and fax act more as supplementary communication methods when it comes to what clients prefer. Although they may not be high on the preference list, they do provide a way of keeping in touch between face-to-face meetings with clients. For example, an SMS can be sent as a follow-up to a face-to face meeting, or as a casual yet personal way to organise a catch-up with a long-term client. Skype can also be used as a substitute for face-to-face meetings when the client is travelling or is unable to meet up in person. A fax can be used to send documents instantly to clients, especially those not on email. While this research highlights trends in client communication preferences, the only way to know for sure how your clients want to be communicated with is to ask them. It is important to never assume that you know what they want!

FREE Video Service

With thanks to Beddoes Institute, the AFA and white paper sponsor, Zurich Financial Services, a series of brief videos, featuring 2013 AFA Adviser of the Year, Jenny Brown, and relating to key points raised in this article, are available for all advisers and other riskinfo readers. Click any of the following links that may be of interest to you and/or your advice practice:

Connecting with Clients delivers insights into how consumers interact with advice professionals, and what the best advice practices are doing to set themselves apart.

Connecting with Clients delivers insights into how consumers interact with advice professionals, and what the best advice practices are doing to set themselves apart.

Dr Rebecca Sheils is Director and co-founder of the Beddoes Institute – Measure, Diagnose, Act.