Are you a risk specialist? Think that TASA doesn’t apply to you? Think again. The latest compliance regime deadline is approaching. From 1 July 2014, advisers who provide tax (financial) advice to clients will be required to comply with the Tax Agent Services Act (TASA). Are you ready?

Who does TASA apply to?

The TASA regime applies to anyone who provides tax (financial) advice to a client and receives a reward for that advice.

How do you know if you’re providing tax (financial) advice? The Financial Planning Association (FPA) has prepared the following test:

- Do you provide advice under an AFSL?

- Do you provide retail clients with personal advice?

- Do you interpret and apply the taxation laws to your client’s circumstances (including income tax, superannuation and SMSF laws)?*

- Is it likely that your client would rely on your interpretation and application of the advice?

If you answered yes to all of the above questions, then you are providing tax (financial) advice.

*Tax laws include tax, superannuation and SMSF laws, because all these are administered through the Australian Taxation Office. This includes the interpretation of the rules applying to insurance held inside superannuation.

Client example of tax (financial) advice

David recognises the need for personal insurance protection and seeks financial planning advice on the amount and type of insurance cover he should take out. He is a member of a superannuation fund that offers a range of insurance cover but could also establish his own personal policies. He wants to maximise the benefits available while minimising the costs to him of the insurance.

David’s financial adviser reviews David’s assets and liabilities and recommends the amount of cover that he requires. The adviser also compares the effects of taking out the cover in his own name through a personal policy and taking out the cover through his superannuation account. As part of this comparison, the adviser takes into account the after-tax cost to David of his insurance premiums and any potential taxation on the benefits payable under the policies.

The financial planning advice on David’s tax position is aimed primarily at illustrating which method of structuring his insurance provides him the greatest benefit at the lowest cost.

Do I have to register with the TPB?

Not all financial advisers will be required to register individually with the Tax Practitioners Board (TPB). Registration is based on the ‘charging entity’ that receives payment for the tax (financial) advice, not the individual providing the tax (financial) advice.

In other words, if your clients pay their fees directly to your licensee, who then passes on the payment to you, for example in an employed representative arrangement, then the licensee is required to register with the TPB as a ‘company’.

If, however, you are an authorised representative or corporate authorised representative and your clients pay their advice fees to you directly, then you will need to register with the TPB. If you hold an ACN, then you need to register as a ‘company’. If you do not hold an ACN, you need to register as an ‘individual’.

Important note:

Even if you are an employee and/or not the charging entity, you may still need to register as an ‘individual’. Companies who register with the TPB are required to have a ‘sufficient number’ of ‘individual’ tax (financial) adviser representatives working within the business. How many registered ‘individuals’ are required will vary depending on the size and structure of the business. It is up to the registered ‘company’ to inform staff members or representatives whether they need to register as ‘individuals’.

Before taking any action, the FPA recommends discussing your registration requirements with your licensee.

What happens from 1 July 2014?

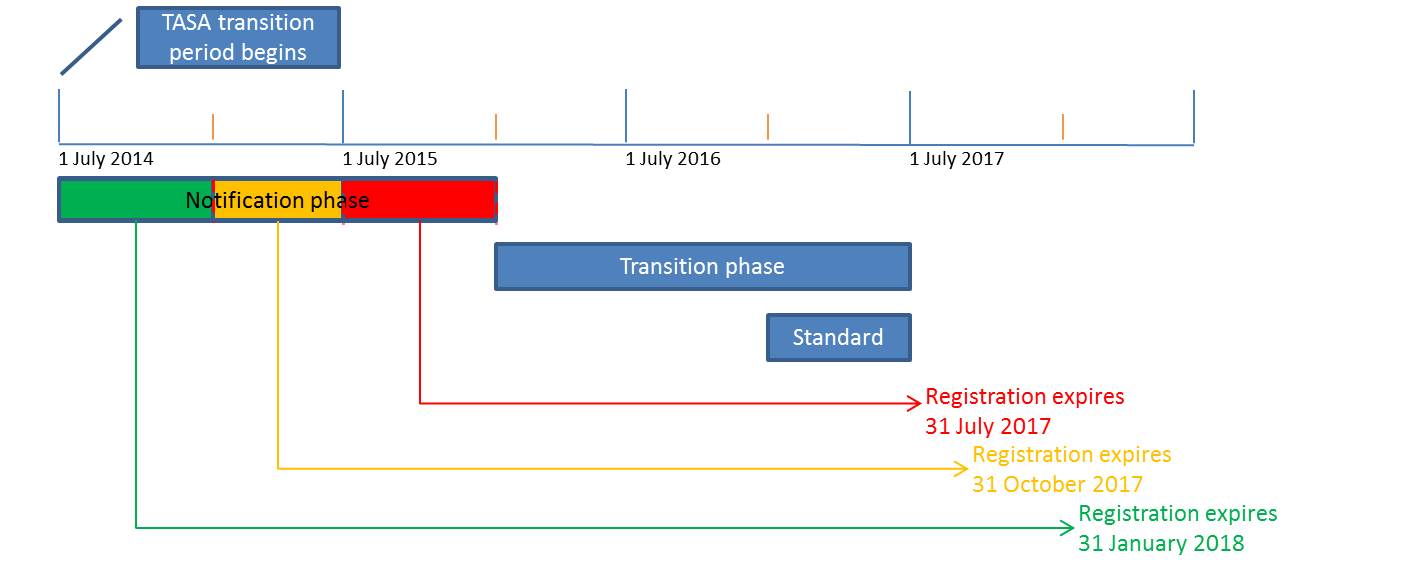

The TASA regime takes effect from 1 July 2014. The TPB has designated a three-year transition period to assist existing financial advice businesses to comply with the new requirements. During this three year period, businesses and individuals who provide tax (financial) advice will need to register with the TPB.

Until you have registered with the TPB, you will need to include an additional disclaimer in your client documentation.

Disclaimer wording:

- The provider of the advice is not a registered tax (financial) adviser under the new law; and

- If the receiver of the advice intends to rely on the advice to satisfy liabilities or obligations or claim entitlements that arise, or could arise, under a taxation law, the receiver should request advice from a registered tax agent or a registered tax (financial) adviser.

Once you have registered (see below), you no longer need to include this disclaimer. The disclaimer can only be used until 31 December 2015. After this date, tax (financial) advisers will be required to register with the TPB.

How do I register with the TPB?

Company (licensees, corporate authorised representatives or authorised representatives with an ACN)

There are three registration phases in the transition period. The requirements are different depending on the phase in which you register:

1. Notification Phase (1 July 2014 – 31 December 2015)

During this phase, you can notify the TPB that you are registering as a ‘company’. There are no registration requirements during this phase and there is no fee for registration at this time.

Once you have registered during the Notification Phase, all your representatives will be required to comply with the TASA Code of Professional Conduct, and you will need to meet the Professional Indemnity insurance requirements.

2. Transitional Phase (1 January 2016 – 30 June 2017)

If you choose to delay your registration until the Transitional Phase, you will need to:

- Meet the minimum experience requirements (note: the Government has yet to finalise these)

- Pay the applicable application fee

Once you have registered during the Transitional Phase, all your representatives will be required to comply with the TASA Code of Professional Conduct, and you will need to meet the PI insurance requirements.

3. Standard Phase (1 January 2016 – ongoing)

If you choose to postpone your registration until 1 January 2016, you must meet all the registration requirements.

Once you have registered, you must meet all the ongoing registration requirements.

Individuals

As with ‘company’ requirements, there are three phases in the transition period for ‘individuals’:

1. Notification Phase (1 July 2014 – 31 December 2015)

During this phase, you can notify the TPB that you are registering as an ‘individual’. There are no registration requirements and no fee for registration is payable at this time.

However, once you have registered as an ‘individual’ during the Notification Phase, you will be required to:

- Comply with the TASA Code of Professional Conduct

- Complete the CPD requirements

- Meet the Professional Indemnity insurance requirements

2. Transitional Phase (1 January 2016 – 30 June 2017)

If you choose to delay your registration until the Transitional Phase, you will need to:

- Meet the ‘fit and proper person’ requirements set out by the TPB (refer tpb.gov.au)

- Meet the minimum experience requirements (note: the Government has yet to finalise these)

- Pay the applicable application fee

- Comply with the TASA Code of Professional Conduct

- Complete the CPD requirements

- Meet the PI insurance requirements

You do not need to meet the registration education requirements.

3. Standard Phase (1 January 2016 – ongoing)

If you choose to postpone your registration until 1 January 2016, you must meet all the registration requirements.

Once you have registered, you must meet all the ongoing registration requirements.

Ongoing requirements

CPD points

Only registered ‘individuals’ will be required to meet the TASA Continuing Professional Development (CPD) obligations.

The TPB has recommended that tax (financial) advisers complete a minimum of 60 hours of CPD over a period of three years. CPD activities that are undertaken by financial advisers for other requirements (such as membership to another professional association) can be used towards the TPB requirements, but it should be noted that they will only be credited on an hourly rate (not as ‘points’). CPD should be relevant to the tax (financial) service provided by the adviser.

Important note:

The TPB has yet to finalise its CPD requirements, meaning the requirements outlined above may be subject to change. The TPB uses the term Continuing Professional Education (CPE) whereas the financial advice industry typically uses Continuing Professional Development (CPD). The terms have the same meaning.

Code of Conduct

Regardless of whether you have registered as an individual, or if your company has registered on your behalf, all advisers who provide tax (financial) advice need to abide by the TASA Code of Professional Conduct.

Many of the TASA Code obligations are similar to what is already required of planners and licensees under the Corporations Act, ASIC Act and other relevant legislation; however advisers should read the full TASA Code of Professional Conduct, which can be found at www.tpb.gov.au

Important note

One of the requirements set out in the TASA Code of Conduct is that ‘you must comply with the taxation laws in the conduct of your personal affairs’. This means you need to ensure your personal and business tax affairs are up to date with the ATO. Have an outstanding personal income tax return? Haven’t lodged your PAYG withholding and instalment payments? These will all contravene the TASA Code.

Professional Indemnity Insurance

Financial advisers who register as a tax (financial) adviser after 1 July 2014 must have PI insurance that meets the TPB’s requirements. The TPB has yet to release the final details of its PI insurance requirements, however the draft requirements mirror those set out under the current Corporations Regulations and ASIC’s Regulatory Guide 126.

The Insurance Council of Australia (ICA) has advised it does not anticipate significant increases in PI insurance premiums as a result of the TASA regime.

In a statement issued in May 2014, TPB Chair, Ian Taylor, said: “We worked on two key principles in developing our view on the PI insurance requirements. Firstly we adopted the requirements of ASIC wherever possible. Secondly, we adopted the principle that in assessing the adequacy of PI insurance cover, practical availability of that insurance at any given time is a relevant consideration.

“For the vast majority of financial advisers, we do not expect that tax (financial) advisers will need to get additional PI insurance policies to what they might already hold to meet ASIC’s requirements. We understand that any increase in PI insurance premiums will only relate to extending PI insurance policies to cover tax advice if they do not already do so.”

Re-registration requirements

Depending on the date you initially register with the TPB, you will be required to re-register, and meet all the registration requirements at this time. The earlier you apply for registration, the longer your period of initial registration will be. This means you will have more time to make sure you meet the ‘sufficient number test’, education and experience eligibility requirements when you renew your registration.

Notification phase

| If you notify the TPB during… | …then your registration expires on… |

| July-December 2014 | 31 January 2018 |

| January-June 2015 | 31 October 2017 |

| July-December 2015 | 31 July 2017 |

Transitional and Standard phase

If you register during either the transitional or standard phase, your registration is expected to expire three years from the date the TPB confirms your initial registration.

More questions?

The information in this article has been sourced from the FPA’s TASA Toolkit, which contains a variety of fact sheets and guides for financial advisers. To access more information on TASA, visit www.fpa.asn.au/tasa, consult your licensee’s compliance officer, or visit www.tpb.gov.au.

The Financial Planning Association (FPA) represents the interests of the public and Australia’s professional community of financial planners. With a growing membership of more than 10,000 members and affiliates of whom 7,500 are practising financial planners, the FPA is home to Australia’s 5,500 CFP professionals.

Contact or follow the author: Telephone: 1300 626 393 | Website | Email | Twitter | LinkedIn | Facebook