Advisers, licensees and life company peers joined forces recently to discuss the issues of the day for Australia’s life insurance industry, particularly in terms of how these issues impact the consumer.

Our panel discussed and identified the ways in which many of these issues are inter-connected and suggested what can actually be done to address them in order to advance the quality of the life insurance conversation with Australian consumers.

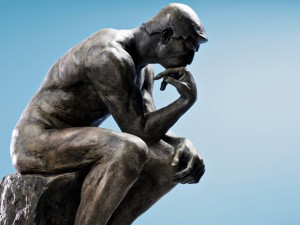

The panel (L to R):

- Dylan Chan (Partner and Adviser, Ark Total Wealth)

- Phil Hay (Head of Life Insurance, BT Financial Group)

- Annick Donat (Head of Strategic Growth – Securitor and Licensee Select)

- Peter Sobels (Editor, riskinfo)

- Jeff Thurecht (Director and Adviser, Evalesco Financial Services)

- Nick Hatherly (Managing Director and Adviser, Australian Financial Risk Management)

- Tracey Crowe (National Manager, Underwriting, New Business and Claims, BT Financial Group)

In discussing the various topics the panel consistently referenced the following attributes in terms of what it believes is required to deliver these better outcomes:

- Simplicity

- Transparency

- Awareness

- Education

- Trust

Complexity – current-day perspective

BT’s Head of Life Insurance, Phil Hay, told the panel he can see how far the industry has come in the last few decades with the range of value-added products and services that have been developed for the consumer (eg: trauma insurance, splitting cover inside and outside super, and key person income protection cover).

“But on the flipside of that is the complexity we have brought into the equation,” noted Phil. “As much as the industry has tried to simplify the life insurance offer, we have instead made it a lot more complex. From a BT point of view, everything we do is based on a customer-centric design, where you start with the customer and the adviser in mind. But as you look back at the development that has taken place, it really starts to highlight just how complex, as an industry, we have made this process. This creates difficulties for both the adviser and the consumer.”

Jeff Thurecht, Director and personal financial adviser at Evalesco Financial Services, agreed with Phil Hay’s assessment: “There’s been a continuing escalation of competition between life companies – a ‘crazy rush’ in a race to see how many individual trauma insurance conditions can be added to the list of events covered under a single policy.” While Jeff conceded this one-upmanship has corrected itself a little in recent times, his point was that this competition has added an extra layer of complexity for the consumer and also for the adviser.

Jeff also noted that, in some ways, the complexity of the life insurance proposition can ironically increase the consumer’s need for advice in the first place, as they navigate their way through determining the right solution for their circumstances.

Dylan Chan, a financial adviser and Partner at Sydney advice firm, Ark Total Wealth, also lamented the level of complexity that has become a standard within the life insurance advice process: “I can see that some of the complexity that has been introduced in more recent times relates back to the style of benefits being offered, such as superannuation flexi-linking and new ways to wrap or package trauma, life and TPD cover together. But, for consumers with only a basic understanding of what life insurance means, this represents an extra step in understanding.” But, while some elements are more complex, Dylan agreed the new styles of benefit also delivered real value. He therefore said he accepts greater levels of product complexity on the proviso that these initiatives ultimately deliver better value for his clients.

Phil Hay switched the ‘complexity’ conversation to the claims area, asking what should happen for the consumer at this stage of the insurance cycle: “The claims approach is now based around the quality of life for the consumer. How do we help the client in their darkest moments?” he asked. “The focus we now have on the holistic needs of the client is an area where the industry has advanced so much.” Similar to the product conversation, however, Phil remarked on the often complex nature of today’s claims processes when there should be transparency. “We still hold the claims process as one of the most closely guarded ‘secrets’ about how it works,” he said. “As an industry, we should be more transparent when it comes to claims… People should be able to see that, from the claims process point of view, there is nothing to hide,” he added.

As an industry, we should be more transparent when it comes to claims

Referencing the 2013 AFA White Paper focusing on The Value of Protection, Phil highlighted his frustration with the disparity between the more favourable claims experiences by consumers who had actually been through a claims process compared with the more negative, confrontational perception of the process held by consumers who had not experienced it. He said would like to see the industry collaborate on a transparent benchmarking process, to build customers’ trust in the industry and improve consumers’ perception of the value of life insurance.

Long-time adviser and newly-appointed MD of specialist risk advice licensee, Australian Financial Risk Management, Nick Hatherly, offered his very firm and simple view on the involvement of advisers in their clients’ claims. “Claims is what it’s all about,” said Nick, “… and advisers who don’t have the skill or interest shoudn’t be advising in risk.”

Nick continued, “But looking at the issue of complexity of products, the question comes back to one of ‘claim-ability’, he said. “Good advisers study those products. They understand the definitions… but I think the level of knowledge in the industry on product design reflects poor management of claims.”

BT’s National Manager for Underwriting, New Business and Claims, Tracey Crowe, suggested the conversation around the nature of the claims process is really starting to change within the industry, more towards ‘what we do’, rather than ‘what we don’t do’.

Tracey told the panel: “What I think is fantastic, in recent times, is that when the industry is talking about rehabilitation and a return to work, the conversation with the customer is becoming deeper and more a about a return to wellness rather than a return to work.”

The notion of a changing approach to consumer claims, from ‘return to work’ to ‘return to wellness’ represents a change in attitude, where the life insurer now seeks to engage at a deeper level with the client/policy holder/consumer, focusing on their broader ‘wellness’ needs rather than simply finding the most expedient path that will get the claimant back to work and ‘off claim’.

“There are also great health benefits associated with a return to work,” continued Tracey. “The customer is not going to go back to work until they feel well enough. So, what we do around claims is to make sure we are on that path to wellness right from the beginning, and then wherever possible a return to work follows.”

Nick made the point that early in the claims process, most clients are wary of dealing direct with life companies due to the perception the insurer would attempt to ‘bounce’ the claimant, and where the consumer perception is that often the first answer is always ‘no’. Nick says advisers’ involvement will improve clients’ trust and confidence in the industry and always get them a better claims outcome.

However, Dylan reflected that some advisers, like many of their clients, also see the claims process as adversarial, which helps neither the claimant, nor the adviser, nor the insurer.

Tracey, Nick and the panel agreed the greater focus on claims was a huge positive for the consumer, but that the industry needs to continue to make efforts to ‘demystify’ the process to make it less confronting, less complex and more transparent for those who must experience it.

Adviser processes and consumer education

Head of Strategic Growth – Securitor & Licensee Select, Annick Donat, told the panel: “When I first started in the industry, most advisers wrote life insurance. But not everybody writes life insurance anymore, because they think it’s a specialist skill.”

Annick outlined a changing philosophy within the Securitor network to develop a consistent and repeatable attitude towards life insurance for all its advisers, in which life insurance forms the basis of every financial plan. (For more on Securitor’s insurance philosophy, click here.)

Nick contended that many advisers don’t really understand the details and processes involved in making a claim, and even that some claims case officers don’t understand what an insurance claim really means, particularly through the eyes of the claimant.

“The education piece sitting behind life insurance isn’t there,” said Nick. “We really need that forward step to be out there in the mind of the public – that insurance is part of everyone’s life. We are the lucky country and we all think the Government is going to support us. But we haven’t got enough money in this country to support everybody, and as an industry we don’t properly get that message out to people,” he said.

Phil contended that the emotional story behind life insurance for consumers has been lost. He cited the journey of trauma insurance to illustrate his point. He noted the origins of trauma insurance, through South African surgeon, Dr Marius Barnard: “It’s a great story, but the message from the story has been lost. Trauma is now just a tick on a needs analysis document and the whole reason for it, and the emotion surrounding the reason for its being, has been lost,” said Phil.

Nick agreed with Phil, but made the distinction between product and advice. “Insurance is just a product,” he said. “Advice is about the risk, the outcome and financial capacity of the client. It should never be a product-focused discussion.”

advisers who don’t have the skill or interest shoudn’t be advising in risk

Further on the issue of complexity, Jeff told the panel that before his clients meet with him they have had little experience with life insurance, other than possible contact via their super fund. “They may see TV ads for life insurance and think it all seems so simple. But when they commence the insurance advice process with us, we’ll say: ‘These are the things you need to think about and these are the risks that are in your life – this is the strategy we have put together and here is a solution’. So it’s us who create the complexity in starting that conversation with the client,” he said.

Tracey and Nick agreed that in terms of clients understanding what may be required in considering their lives and their protection needs, as well as the process of applying for life insurance, it all comes back to education. Tracey said there’s the ‘awareness piece’ that is lacking in the minds of so many consumers, but asked how that awareness, once achieved, can become advocacy in the absence of having to make a claim. “How do we bring down the gap between knowing something needs to be done and actually doing it?” she asked.

Annick suggested the answer lies in advice “… because if you are having that conversation with clients about putting their insurances in place, and it’s seamless and you have a really good, reasonable basis for why you’re having this conversation – and the client understands that conversation because they are being educated – then you’ll start narrowing that gap.”

Annick suggested the answer lies in advice “… because if you are having that conversation with clients about putting their insurances in place, and it’s seamless and you have a really good, reasonable basis for why you’re having this conversation – and the client understands that conversation because they are being educated – then you’ll start narrowing that gap.”

Annick added that the nature of the adviser/client conversation needs to be ‘humanised’. She said that when it comes to insurers developing actuarial tables, it’s all about knowing the demographics; not the person. “But life insurance is all about the person. The whole industry is built around tables and not human beings. And that’s where we’re losing the opportunity. It’s really important for us to see the opportunity that presents itself when our industry looks after people as individuals, considering their own issues, rather than seeing them as numbers.”

Transparency

To achieve the goal of consumers feeling they are being treated as individuals rather than as numbers, Phil emphasised the importance of transparency in the advice process. “We need to be releasing many more benchmarks about what we do – not just about how many claims were paid, but how many people we helped to retrain; how many people we helped to rehabilitate themselves; how many people we provided counselling for. Without utilising the ‘fear factor’, these messages show the huge amount of dollars paid back to clients on claims, including the financing of rehabilitation services,” he said, adding “So it’s the value of positive reinforcement – of looking at all these families that have been helped because they got advice from someone who knew what they were talking about.”

The panel agreed that once the client is sitting in front of the adviser and they become educated, they see there is only one way to go in terms of protecting themselves and their family and/or business. But the challenge, agreed the panel, was getting the client together with the adviser in the first place.

Mass marketing messages

Looking to mass marketing opportunities as a way to link more consumers with advisers, the panel generally agreed that TV ads don’t send the right message. They agreed that life insurance needs to be part of an advised discussion, where Phil referenced research showing that if consumers talk to a financial adviser they are five times more likely to get the cover they actually need. “That is a powerful statistic,” he said.

Jeff also expressed frustration with the questionable quality of directly-marketed advice calls to consumers. “People put us in the same bucket as those direct-to-consumer advice calls, which gives us a poor reputation,” he said.

Responding to Tracey’s point about the real challenge being how to get the client to sit down with the adviser in the first place, Annick emphasised that the message about consumers being five times more likely to receive the appropriate cover through advisers is the message the consumer needs to be hearing. She feels this is the right mass message, rather than emotive or price-sensitive TV ad promotions for life insurance.

Nick agreed with Annick, again bringing the conversation around to the critical importance of education and financial literacy. “And it has to start in high schools,” he said.

Tracey also stressed the importance of sending the life insurance message to people under age 35 while they are young and healthy, because it is then guaranteed for life. She agreed with Annick, Jeff and Nick that the life insurance and financial literacy message needs to be delivered to both schools and universities.

the conversation with the customer is becoming deeper and more a about a return to wellness rather than a return to work

Annick commented: “It’s interesting that we agree that education underpins everything. I believe there exists a great opportunity for us to take the financial literacy message into to schools.” She related her own daughter’s primary school experience when listening to a talk on financial literacy from her father, who is an adviser. Annick used her personal example to demonstrate that even at primary school age, children are able to appreciate basic lessons about saving and budgeting and how this may help their parents in their various occupations. “It shows the financial education conversation is ‘do-able’ at young ages,” she concluded.

The panel then discussed what education message the industry should be delivering to the community. “There are two conversations: financial literacy and financial wellness, and they’re two different messages,” Annick said.

“You have to be personal — you have to know me, not my demographic. This applies to financial literacy and financial wellness and what they both mean to me, not my demographic. If it’s one of the 50% of married couples who don’t have cover, and they’re talking to their bank manager, the message should be more about ‘you need to get advice’ rather than ‘you need to see one of our planners’.”

Dylan then pointed to education in terms of the need for advisers themselves to continue to stay up-to-date. By way of example, he cited a recent change in legislation where the own occupation disability definition will no longer trigger the payment by trustees of an income protection claim inside super, even if the claimant meets the criteria. Dylan and his team are currently reviewing their client files in order to ensure all their clients have the right cover, either inside or outside the superannuation environment, or both, that will actually deliver a claim benefit if they meet the criteria. His point was that so many advisers across the country do not seem to be aware of what is both a current issue and also a great opportunity to add value to their clients.

On this same issue Dylan also brought the panel back to the point of complexity in the advice environment, remarking that the complexity this new statute creates makes it more difficult to properly serve the best interests of their clients.

Nick agreed with Dylan’s observations, commenting on how difficult it is, as a licensee, to recruit advisers with that updated level and depth of knowledge. Given these comments, the panel fully supported the notion that issues need to be addressed for both consumer and adviser education.

The panel discussed the value (or otherwise) that they believe their practice would derive from a mass consumer-focused life insurance and financial education promotional program. Dylan: “We talk to clients about a range of advice and once they’re in front of us we have a very high conversion rate. But if there was a mass campaign that got people thinking about life insurance and got them to ask questions, then that would help bring more people through our door.”

Jeff commented that in an age where technology has created more avenues through which to communicate and have a voice, he believes this is where social media and blogs, etc, can play a role – by spreading ideas amongst people as to what they should be thinking about.

“If we can get support in providing that information to more people, then yes, a mass campaign, from the adviser point of view, would be of great value,” he said.

However, Nick remains unconvinced about the potential value of a mass advertising campaign on financial literacy and education. He holds that “… getting people to knock on your door is almost impossible.” This is the reason Nick emphasises the critical importance of building and enhancing referral networks and partners, because he believes this activity will ultimately deliver more productive results for his business than a mass general advertising campaign.

Annick, however, asked whether the industry had an obligation to promote awareness and understanding. She said the industry fund and direct TV campaigns concern her because neither sends a message about the importance of advice. Her argument is that education is the key; not a mass ‘buy this product’ campaign.

Nick, Tracey and the panel agreed that any mass consumer campaign must come across as educating, rather than as advertising or promoting; otherwise it won’t have the desired effect.

Dylan shared with the panel a particular client case study in making a point about consumer education, which prompted Annick to suggest “… there is a case study in almost all families.” Her messages to riskinfo readers is that advisers should ask clients about their own experiences, in addition to relating to their clients the experiences of others.

Phil suggested any mass financial education campaign may succeed by addressing the issues that keep people up at night. “What are the really serious things that you worry about every day?” he asked, saying this is where the consumer’s mind should be directed in terms of engaging with financial education.

National adviser register

Advisers, licensees and life company panellists all supported the notion of a central national register of all financial advisers. While Nick agreed the register would deliver possible peace of mind for the consumer, he said this would act as no guarantee that consumers would be protected from poor advice or be subject to future inappropriate adviser activity; his point being that a national adviser register cannot stop poor advice. But the panel was generally supportive of its creation. Nick: “Anything that can be done to help the image of the advice industry would be a good thing.”

How do we bring down the gap between knowing something needs to be done and actually doing it?

Phil agreed, commenting that: “Anything that helps to promote the value of the discussion, the more ‘proof points’ we can add, and the more transparent we can be, the better we will become as an industry. It’s all about the consumer saying ‘How can I find someone I can trust?’”

Jeff, however, raised the issue of the potential for a ‘rogue’ adviser included on the central register to have his/her activities aired on mainstream media, feeling this would immediately damage the credibility of the register as a trusted source of advice for consumers.

Ownership of distribution channels

The panel reflected on whether consumers would be better served if product manufacturers did not own distribution chains.

There was a general air of pragmatism in the room about how the system works today, amid calls by some sectors, including the Financial System Inquiry, that product and advice should be separated, in the interests of the consumer. That is, life companies should not own distribution groups. The response from Phil Hay was that the industry operates under a system that delivers appropriate outcomes for consumers and that consumers are not disadvantaged by receiving advice from an adviser whose licensee is owned by a product manufacturer.

Annick’s uncomplicated approach was that “…great advice is great advice.” But on the point of perception, Annick responded that it’s not consumers who create the perception issue surrounding product manufacturers owning distribution. Rather, it is the industry itself that creates the perception issue. Reflecting what she believes to be a typical consumer approach, Annick said: “I don’t care who owns my adviser’s licensee group. My relationship is between my adviser and me, and that’s all that matters.”

Tracey noted that if the client trusts the adviser to deliver advice that is in their best interests, then it shouldn’t matter who owns the adviser’s licensee.

Nick commented that as long as the ownership of the licensee is transparent and fully-disclosed, he doesn’t see a problem. “As long as people know what they’re getting, there’s not an issue,” said Nick. “Does a Ford dealer sell Fords? In other words, the product manufacturer has a right to ask the adviser for his business, as long as the relationships are declared.”

Dylan told the panel he accepts it is difficult and complex to ‘unpick’ the existing model, but that he does have concerns. “There’s a pragmatism around the fact that the model won’t change. But I do see very real problems with it, almost akin to pharmaceutical firms owning doctors surgeries and medical practices,” he said. “Would patients be happy with that structure? I would prefer to see our industry headed down that path of independence.”

But from Nick’s perspective, “…if you go into a bank-owned channel and the client is aware that it’s a bank-owned channel, then that should be ok. You are likely to get a bank product. It’s then up to the customer to determine whether the advice they receive is in their best interests.”

Jeff commented: “Potentially, I could envisage a separation between manufacturers and advice distribution models. But in reality it’s not that simple. It’s very difficult for licensees to make a profit and build their business without institutional backing. And that then becomes a problem for everyone, if the adviser and his/her licensee can’t continue providing advice because it’s not profitable to them to do so.

“So you need to make sure there is absolute transparency for the client when they’re dealing with advisers whose licensee is owned by a product manufacturer. And the adviser should be proud to say that it doesn’t affect the advice they deliver to their client.”

Nick’s pragmatic summary on this topic was: “We get so wound-up discussing the model. But the consumer doesn’t have the same investment in the debate. All they want is unbiased advice.”

Independent and restricted advice

…And there was little support for the recent call to categorise advisers as providing either ‘restricted’ or ‘independent’ advice. Jeff said: “Advice is advice. It doesn’t matter whether it’s seen as either restricted or unrestricted.”

Annick noted that if any Securitor adviser was told they were providing ‘restricted’ advice “… they would laugh at you because they’re not. They are great advisers; well qualified and more than capable of giving the proper advice to anyone”.

“I work with self-employed business owners. They all run their own business and I guarantee you they would feel affronted if they were found or perceived to be delivering restricted advice,” she added.

Annick also emphasised the importance of the relationship between manufacturer and adviser: “It’s also about ‘Do you know me? Do you know my book of business? Do you know my insurance philosophy?’ If you understand that, then this helps determine the panel of insurers that I want to be able to use. Bringing it back to an insurance conversation – at the end of the day, it’s all about getting the client insured with a solution that reflects their needs.”

Nick agreed: “It’s relationship based. If I have a good relationship with the insurer, then I can talk to the right claims people and I have those good relationships with several insurers where I can go to the CEO if I need to and say ‘this decision is wrong’. Isn’t that good for the consumer?”

Nick agreed: “It’s relationship based. If I have a good relationship with the insurer, then I can talk to the right claims people and I have those good relationships with several insurers where I can go to the CEO if I need to and say ‘this decision is wrong’. Isn’t that good for the consumer?”

Tracey and the panel agreed reciprocal trust between adviser and insurer plays a big role in determining where life insurance business is placed.

Jeff raised the now out-dated volume bonus structure as a negative in the argument that there should be no differentiation between restricted and independent advice. In naming the elephant in the room, Jeff noted “… 99% of advisers do the right thing by their clients. But ultimately banks own distribution in order to get a larger slice of the product cake.”

Trust plays a big part between company and adviser and gets back to relationships. “If I have a good relationship with a particular insurer, because we know each other and are comfortable dealing with each other, we will continue to do business,” he added.

the message should be more about ‘you need to get advice’ rather than ‘you need to see one of our planners’

When it came to a discussion about approved product lists in relation to ‘restricted’ versus ‘independent’, the panel generally agreed that any adviser operating under an APL structure was effectively restricted in terms of the range of solutions they were capable of delivering, and that it would be possible for an adviser working under a vertically integrated structure to offer more product solutions through an APL which contained a larger volume of options, compared with a smaller APL utilised by a an adviser working through an independently-owned licensee.

Policy replacement/switching

Nick raised the issue of keeping products relevant against a back drop of the discussion about churning and poor advice. He said that on the one hand, the regulator is raising the issue of churning; but on the other hand, the Government has instituted the client best interests statute as part of the FoFA reforms. “To me, ‘best interests’ means getting the best outcome I can get for my client, but the two issues clash.

“Our business doesn’t make money giving replacement business advice, so it’s against my interests to even consider the better product for my client. However, we do need to do that, because it’s in the best interests of my client. So, don’t give advisers a reason to move the client! Make the product future-proof.”

Nick also advocated the removal of upfront commission on replacement business, arguing this would remove any financial incentive for advisers to move clients’ policies.

Addressing Nick’s issue, Phil agreed that new product features should be ‘grandfathered’ back to existing policy holders in order to ensure their access to these new features and benefits. His strong view was that it is not the adviser’s ‘option’ to move their client to a better product solution. Rather, it is their ‘duty’. “If you see something that is more appropriate for your clients’ needs and you don’t move them, then I don’t think you’re properly discharging your duties,” he warned.

Jeff agreed with a response by Tracey that insurers need to ensure their products are sustainable and remain relevant for the policy holder so that they did not need to change or upgrade their policies. But he also pointed to the rate of change and frequency of product enhancements as a disincentive for advisers to recommend level premium contracts for their clients.

Nick agreed with Jeff that if the product could be guaranteed to remain relevant for the client, he would advocate writing all insurance on a level premium basis. “And we can say to the client: this will last you for life.”

In reality, however, Tracey pointed out that all the (medically) good lives move, while the insured lives which develop health problems stay where they are, and eventually ‘give up’ on their out-of-date cover.

Annick: “It’s not just about keeping products relevant; it’s a cyclical issue as well, because people aren’t as healthy as they used to be. Stress levels are different and there have been more medical advancements. So it’s not just keeping the product relevant but also these societal issues that must be taken into account.”

Dylan said his clients certainly didn’t want to go through an application and underwriting process if they don’t need to. “So I have to be able to demonstrate the value in switching. You don’t do it lightly and you always have to justify your reasons.”

Final comments

Nick Hatherly: We talk about education for the consumer and education for the adviser and the quality of their advice. The solution for better quality advice rests in grass roots training, which not enough advisers are receiving, especially in the risk area, as opposed to mandating higher minimum qualification levels.

Tracey Crowe: I can’t stress too much the importance and enormity of the education message, both from a financial literacy perspective and the task in raising awareness enough so that consumers get to the advice stage. We must then find a way to create advocacy throughout the life of the policy. And because of the enormity of the challenge, it’s critical that insurers and advisers work together.

Jeff Thurecht: It’s great to have these sorts of conversations where everyone is working towards the same end. But I also think it’s important to improve the perception of the value of advice in the mind of the consumer, which is holding the industry back from delivering value to more Australians.

Annick Donat: I would like to see an industry-wide strategy developed around consumer education. This is one area that we can influence as an industry collective – by understanding the importance of claims; by having those ‘human’ stories as a way to bring home the importance and value of life insurance, because insurance changes lives.

Phil Hay: This is an industry I’m proud to be a part of. This whole conversation around trust – the trusted relationship, the trusted adviser – is so critical. This even applies to the relationship with direct insurance. If the consumer trusts someone to provide a service in their best interests, it will work better for the client, because they trust you. Sometimes we forget the basics as to why this is such a great industry.

Dylan Chan: There needs to be a level of education and an approach towards the public that encourages them to sit down with an adviser to establish their needs and then serve those needs.